FAO hosts second meeting of the Smallholder and Agri-food Finance and Investment Network - SAFIN.

Investing in family farming and rural development is key to delivering on the 2030 Sustainable Development Agenda – from ending poverty and hunger to creating decent jobs, especially for young people, and stimulating inclusive economic growth.

Yet many small producers, rural businesses and potential investors face challenging market conditions and policy environments, with high transaction costs and multiple sources of risk.

The Smallholder and Agri-food Small and Medium Enterprises (SMEs) Finance and Investment Network (SAFIN) brings both demand and supply side stakeholders together to examine challenges around reaching small- and medium-scale rural actors, evaluate solutions, advocate for policy change, promote innovation and experiment with new approaches and instruments.

On 27 and 28 November, SAFIN held its first workshop and second partners' meeting, focusing on understanding and responding to agri-food and rural SMEs’ demand for finance, as well as aligning partners around key areas of collaboration for the next year.

The event, hosted by FAO, drew around 30 participants from various organizations, including FAO’s focal point for SAFIN and staff from FAO’s Investment Centre.

Currently incubated by the International Fund for Agricultural Development (IFAD), SAFIN aims to align the efforts of different types of institutions in the finance and investment ecosystem in which agri-food and rural SMEs operate, including small commercial farms.

“SAFIN presents an important opportunity for FAO,” said Michael Clark, FAO’s coordinator for the cross-cutting theme of governance and SAFIN focal point. “The network provides a forum for shaping international action on financing and investment issues faced by the world’s 475 million smallholders.”

FAO Investment Centre economist Julien Vallet noted that agri-food systems and rural SMEs are essential to absorb the growing workforce in many emerging markets, attracting young, innovative and dynamic entrepreneurs and delivering goods and services to entire food value chains.

“Closing the financing gap can help particularly when it comes to employment, food security and nutrition and provide a pathway out of poverty,” he said. “The SAFIN network aims to find the best blended finance instruments to support these enterprises.”

SAFIN priorities

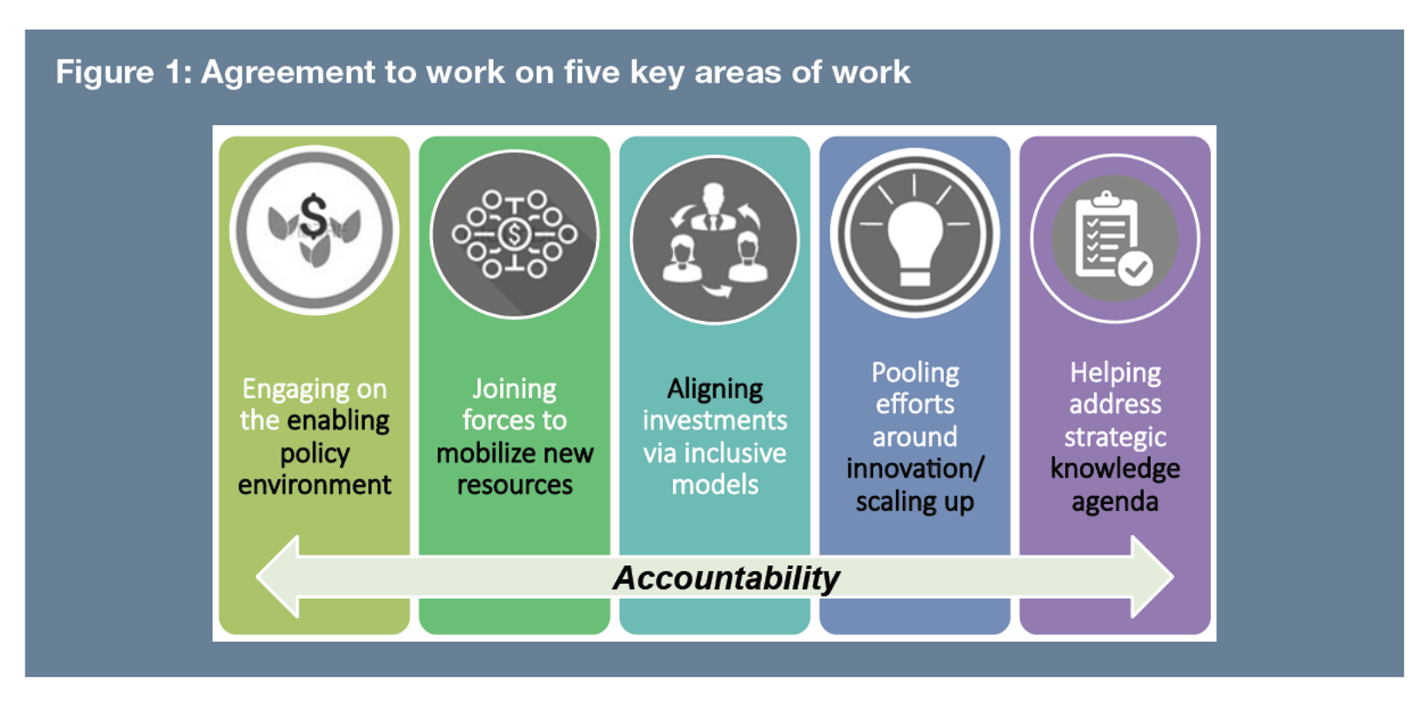

Network members discussed SAFIN’s five action areas – from enabling the policy environment, mobilizing new resources and aligning investments, to pooling efforts around innovation and strengthening the strategic knowledge agenda (see Figure 1).

“The vision of SAFIN is one of an effective and inclusive ecosystem for agri-food and rural SME finance and investment," said Bettina Prato, Senior Coordinator for SAFIN in IFAD. “The network is a co-creation exercise of participating institutions. Partners have a shared interest in working together around the five action areas, and are committed to improving accountability as a cross-cutting area of work."

Closing the financing gap

During the meeting, IFAD shared its plans for the Smallholder and SME Investment Finance Fund, or SIF. The fund will provide debt and equity finance ranging from USD 50,000 to USD 1 million to agri-food SMEs.

These rural enterprises – the so-called ‘missing middle’— are often too small to obtain loans from commercial banks and development finance but too large to access microcredit services.

By integrating SIF with IFAD’s country programmes, the fund hopes to generate a pipeline of investee companies buying from smallholder farmers.

The idea is for IFAD to provide the inital capital, with funds eventually being leveraged by commercial funding sources. The initiative was welcomed by IFAD’s Board in December 2017.

Better alignment of finance and investment actors

SAFIN members also discussed the concept of developing ‘investment prospectuses’ (IPs) to provide, for any given location, an overview of the smallholder and agri-food SME sector, including the policy, regulatory and institutional environment and financial ecosystem.

IPs would facilitate strategic decision-making and collaboration among actors and institutions at country level, bringing together actors and institutions in finance and agriculture and related value chains.

IPs would also highlight potential opportunities to improve investment flows by and for smallholders and agri-food SMEs, and provide a directory of industry associations, government bodies and other institutions.

“Over time, IPs could prove useful to those designing investment projects funded by international financing institutions, such as the World Bank, IFAD and the European Bank for Reconstruction and Development, and help strengthen coordination among actors in the agrifinance and SME space,” said Frank Hollinger, an FAO Investment Centre economist. SAFIN plans to test the concept in several African countries.

Next up

The coming year will be important for SAFIN, said Prato, as “we need to deliver both near term value to individual partners and longer-term impact on the broader ecosystem, with a clear contribution to addressing the financing and investment gaps faced by rural SMEs within the timeframe of the 2030 Agenda.”