The experience of the FFEA of LAPs in Central America

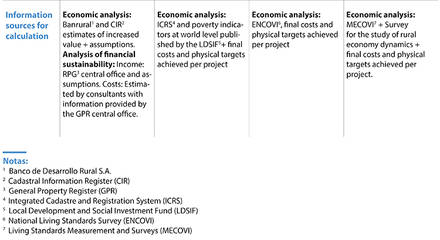

This section addresses the experience of the FFEA of a group of four LAPs in the implementation phase in Central America. They have all completed at least their first phase and have therefore undergone an ex post evaluation, including an analysis of economic and financial feasibility and fiscal impact. They are the LAPs in El Salvador, Guatemala, Honduras and Nicaragua. A comparison of the economic analyses of LAPs yields a summary of the general information from these LAPs, the results of their corresponding economic analyses, the methodology used and the sources of information used for the analysis.

In terms of their economic indicators, all the LAPs showed economic internal rates of returns (E-IRR) greater than the discount rates selected for the analysis, and the NPV of the incremental benefits were therefore positive. With the exception of Honduras, all the E-IRR calculated were above 20%, being greater than the discount rate around 9% In the case of Honduras, the economic indicators were positive but more modest, mainly because the physical goals achieved were significantly lower than anticipated.

As regards analysis methodologies, all four cases used as the main economic benefit the fact that the increase in property value is associated with an improvement in legal certainty and security of tenure. The economic analysis included other types of benefits only in the case of El Salvador: (I) impact on the banking system; and (II) savings in costs and time for users. In three of the four cases, the economic analysis of simple econometric estimations was used to determine the effect of titling on land value. Only in the case of Guatemala was information on the size of this increase estimated based on the empirical knowledge of qualified personnel of national institutions. As regards the costs included in the analysis, Guatemala was the only country to include all costs, while the others included only costs that were considered directly related to the economic benefits recorded and a proportion of the administrative costs of the project.

A financial sustainability analysis was carried out only in the case of Guatemala for a decentralized office of the General Property Register, along with an estimation of fiscal impact. All the other cases confined themselves to carrying out an E-CBA.

We can conclude from the above that:

The increase in property value is the main economic benefit, most readily measurable by FFEAs, however it is also possible, without being extremely complicated, to estimate other economic benefits of LAPs, as in the case of El Salvador. The estimation of other economic benefits is of key importance when evaluating economic viability incorporating all investment costs.