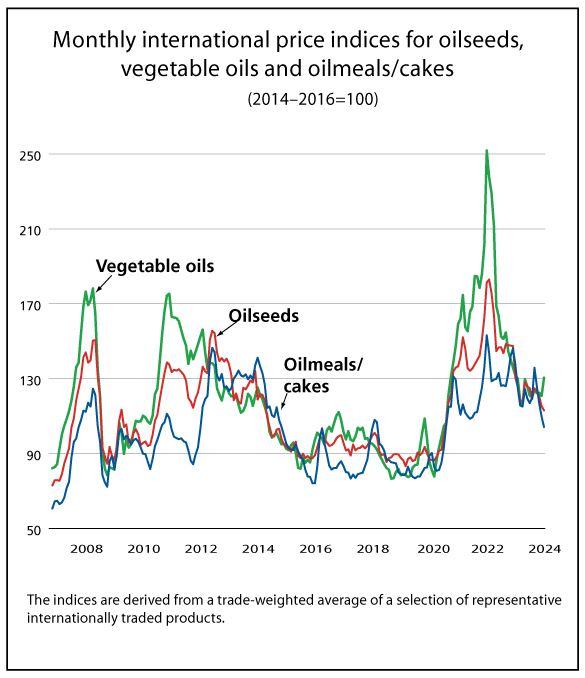

FAO price indices for oilseeds, vegetable oils and oilmeals

In March 2024, the FAO price indices* for oilseeds and oilmeals continued to decline, shedding, respectively, 2.2 and 5.4 points (1.9 and 4.9 percent) from the previous month and standing 13.4 and 24.2 percent below their respective year-earlier levels. By contrast, the vegetable oil price index rebounded markedly, up 9.7 points (8.0 percent) from February and reaching a one-year high.

The further contraction of the oilseed price index chiefly reflected lower global soybean quotations, more than offsetting higher rapeseed prices, while sunflower seed values remained practically steady month-on-month. International soybean prices decreased for the fourth consecutive month in March hitting the lowest level since November 2020, largely underpinned by well advancing harvest operations in Brazil, as well as a favourable production outlook in Argentina where the soybeans will be harvested from April onwards – despite sporadic excessive rainfall across the country. In addition, confirmation of higher planting intentions for 2024/25 marketing year (September/August) than in the previous season in the United States of America, coupled with lingering subdued global import demand, also exerted downward pressure on soybean prices. Conversely, world rapeseed prices rebounded in March, with the support from lower crop prospects for 2024/25 across Canada, the European Union and Ukraine outweighing the negative impact of current abundant global supplies on prices. As for sunflower seed, international quotations fluctuated within a narrow range during March and stayed virtually stable on a monthly basis, as the market condition remained largely unchanged, featured by relatively ample availabilities from the 2023 crop in the Black Sea region.

In the case of oilmeals, the price index registered a fourth successive monthly decline in March, mostly on account of lower soymeal quotations, which followed the trend of soybean prices amid prospects of record production in South America. Furthermore, on the consumption side, lingering lacklustre global feed demand from the livestock sector, as well as heightened competition from cheaper feed grains, particularly wheat that could provide protein content in feed rations, also contributed to a soft tone in oilmeal prices.

As for vegetable oils, the marked rebound of the price index reflected higher price quotations across palm, soy, sunflower and rapeseed oils. International palm oil prices continued to increase in March and maintained their unusual price premiums over competing soy and sunflower oils in some destinations, mainly underpinned by seasonally lower outputs in leading palm oil producing countries that coincided with firm domestic demand in Southeast Asia. In the meantime, world soyoil prices recovered from multi-year lows, mostly supported by continued robust demand from the biofuel sector, particularly in the United States of America and Brazil. Likewise, sunflower and rapeseed oil prices recovered in March, amid rising global import demand. Furthermore, higher crude oil prices also contributed to the increase in vegetable oil quotations.

|

|

* The monthly Monthly Price Update is an information product provided by the oilseeds desk of the Markets and Trade Division of FAO. It reviews the development of international prices for oilseeds, oils and meals as reflected by FAO’s price indices. Previous issues can be downloaded from the FAO website at the following webpage: https://www.fao.org/markets-and-trade/publications/en/?querystring=oilseeds

Please note that the views expressed in this information product are those of the author(s) and do not necessarily reflect the views or policies of FAO.

Explanatory notes:

FAO's price indices are calculated using the Laspeyres formula; the weights used are derived from export values of each commodity for the 2014–16 period. The indices are based on the following international spot prices for nearest forward shipment (provided by Oil World):

- Components of the oilseeds price index: soybeans, US, cif Rotterdam; Copra Phil./Indo., cif NW Eur. port; rapeseed, Europe, 00, cif Hamburg; linseed, Canada, No.1, cif NW Eur. port; sunflower seed, fob Black Sea (please note that sunflower seed has been added to the index only in January 1976 and, until December 2012, referred to EU, cif Rotterdam).

- Components of the vegetable oils price index: soybean oil, Dutch, fob ex-mill; sun oil, EU, fob NW Eur. port; rape oil, Dutch, fob ex-mill; groundnut oil, any origin, cif Rotterdam; cotton oil, US, PBSY, fob Gulf; coconut oil, Phil./Indo., cif Rotterdam; palmkernel oil, Mal./Indo., cif Rotterdam; palm oil crude, cif NW Eur. port; linseed oil, any origin, ex-tank, Rotterdam; castor oil, ex-tank Rotterdam.

- Components of the meals/cakes price index: soy meal, 44/45%, fob ex-mill Hamburg; sun pell., 37/38%, Arg., cif Rotterdam; rape meal, 34%, fob ex-mill Hamburg; copra exp. pell., Phil., domestic; palmkernel exp., 21/23%, cif Rotterdam.