Crayfish market dynamics in China: Early arrival and price drops

On 3 May 2024, Beijing Daily reported that the first batch of live crayfish this year was marketed in the beginning of March, earlier than in 2023; prices also dropped by about 20 percent compared to last year.

According to the report in VOC, Hunan Daily on 20 March 2024, a spokesperson for Mawangdui, one of the biggest seafood markets in Changsha, Hunan Province, revealed that the current price of small-sized green crayfish is around CNY 15-16 /0.5kg, while large-sized green crayfish is going for CNY 32-33 /0.5kg, a slight drop from previous levels.

In contrast, the Jiangyang Aquatic Product Wholesale Market in Shanghai sells medium-sized green crayfish for CNY 25 /0.5 kg and large-sized green crayfish for CNY 30-35 /0.5 kg. Wholesale prices fluctuate daily due to varying volumes of daily local catches. However, overall, this year's market price is lower on average compared to the same period last year. Traders at the Jiangyang Aquatic Product Wholesale Market believe that the increase in supply is the main reason for the price decline, as per the coverage in the Shanghai Morning Post dated 3 April 2024.

According to Guo Song, Director of the Comprehensive Office of the China Crayfish Trading Center, the big catches of crayfish in the past two years were due to warm winters, causing prices to decline due to the sufficient supply. As temperatures increase and the consumer market expands, a continuous rise in the trading volume of crayfish is expected, which may cause prices to drop further.

Crayfish is a popular food in China. Since the late 1990s, the crayfish culinary trend has swept the mainland and made China the world's largest producer and consumer. Crayfish can reproduce year-round, with peak breeding occurring from May to September. As a result, crayfish are typically available in the Chinese market starting from April, with peak supply by mid-May, and continuing until October. As mentioned above, this year, crayfish came to the market half a month earlier than the same period in 2023, accompanied by a price drop.

India-EFTA Trade and Economic Partnership Agreement: Tariff concessions for fisheries and aquaculture products

On 10 March 2024, India and the European Free Trade Association (EFTA) members – Switzerland, Norway, Iceland, and Liechtenstein – signed a free trade agreement, namely the Trade and Economic Partnership Agreement (TEPA). It includes 14 chapters, addressing trade in goods and services, investment promotion and cooperation, dispute settlement, government procurement, intellectual property, trade and sustainable development, as well as competition, among other trade-related issues.

Under the purview of trade in goods, India and the EFTA countries have granted each other tariff concessions, which are commitments between nations to lower or remove duties in order to enhance market access and facilitate the trade of such goods. The following sections refer specifically to fisheries and aquaculture products traded between India and the EFTA nations, and the impact of the free trade deal on these goods.

Tariff concessions by EFTA

A total volume of 86 408 kg of crustaceans (crabs, shrimps and prawns) were imported into Iceland in 2023, making this product category the top import from India, followed by prepared or preserved fish, and molluscs. Previously subject to 10 percent import duties, these products are now exempt from any tariff measures.

In Norway, frozen shrimps and prawns from India, as well as smaller volumes of fish fats and oils and fish fillets, already enjoy zero percent import duty.

Similarly, in Switzerland and Liechtenstein, the leading imported aquatic goods from India comprising frozen shrimps and prawns, frozen cold-water shrimps and prawns, cuttlefish, crabs, and other fish, are already subject to zero percent import duty.

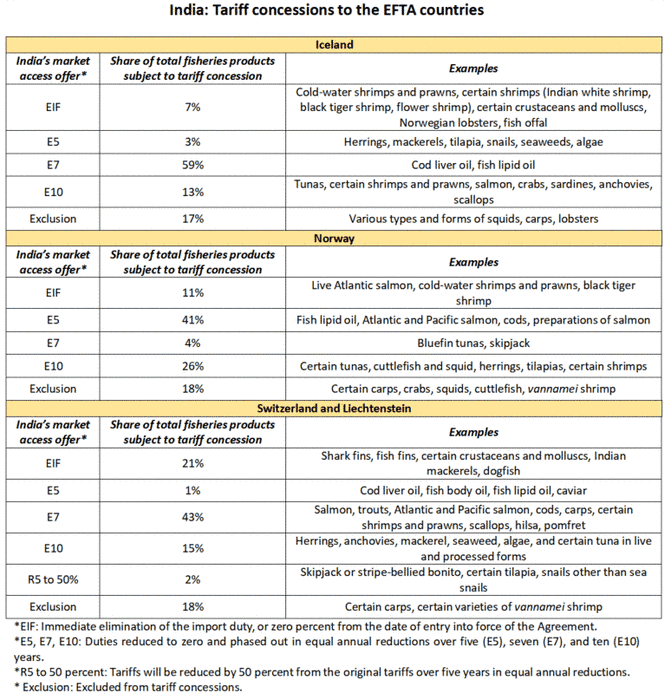

Tariff concessions by India

India’s key tariff concessions for fisheries and aquaculture products include a tariff reduction scheme, as follows:

• immediate elimination of the import duty;

• a gradual phasing out of the import duty in equal annual reductions over five, seven, and ten years until it is completely eliminated; and

• a 50 percent reduction of tariffs, wherein some goods will see a halving of the original import duty over five years (R5 to 50%).

The concessions by India represent a significant reduction in the tariff barriers for EFTA exporters, considering that most fisheries and aquaculture products were previously subject to nearly 30 percent import tariffs.

Among the EFTA countries, India imports the most fisheries and aquaculture products from Norway, albeit in small quantities. The zero tariff under the free trade deal is expected to significantly impact India’s imports of live Atlantic salmon, which accounts for a considerable share of the supply from Norway. Similarly, other prominent imports from Norway, such as fish lipid oil, Atlantic and Pacific salmon, cod, and salmon preparations, will be phased to zero tariffs over five years.

Top Icelandic imports, most notably cod liver oil and fish lipid oil, will have tariffs reduced to zero over seven years in stages.

Meanwhile, India’s imports of fisheries and aquaculture goods from Switzerland are relatively low and primarily consist of processed fish products. These products were not included in India’s list of concessions and, therefore, are exempt from any commitment to reduce or eliminate customs duties.

When comparing India’s tariff concessions extended to EFTA members, most immediate tariff eliminations (EIF) are applicable to imports of fisheries and aquaculture products from Switzerland and Liechtenstein; followed by Norway and Iceland. Their respective shares of total fisheries products subject to tariff concessions are 21, 11, and 7 percent, respectively. Tariff concessions for Switzerland and Liechtenstein are common as Liechtenstein applies the tariff rates of Switzerland.

The following Table depicts the tariff concession rates by India to the EFTA countries, for various fisheries products.