FAO Food Price Index

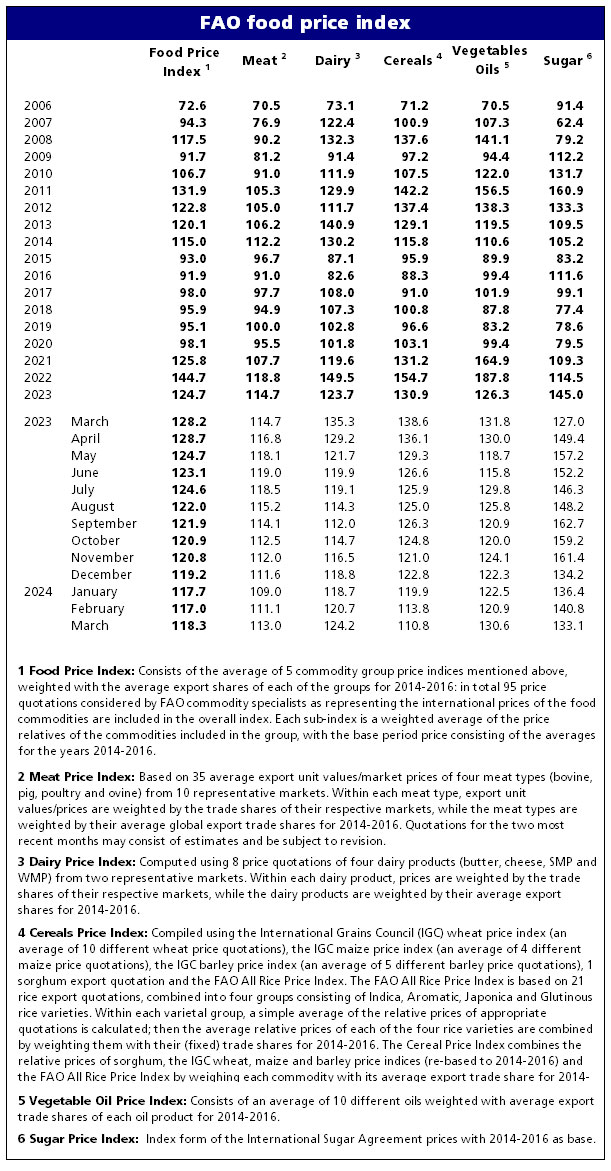

The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups over 2014-2016. A feature article published in the June 2020 edition of the Food Outlook presents the revision of the base period for the calculation of the FFPI and the expansion of its price coverage, to be introduced from July 2020. A November 2013 article contains technical background on the previous construction of the FFPI.

Monthly release dates for 2024 (tentative): 5 January, 2 February, 8 March, 5 April, 3 May, 7 June, 5 July, 2 August, 6 September, 4 October, 8 November, 6 December.

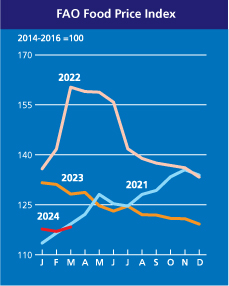

After seven months of decline, FAO Food Price Index ticks up in March, mostly driven by higher world vegetable oil prices

Release date: 05/04/2024

Download datasets:

| Excel: Nominal and real |

| |

| |

| For export quotations of various foodstuffs and national retail/wholesale prices of foods please visit FAO’s Food Price Monitoring and Analysis (FPMA) Tool |

» The FAO Food Price Index* (FFPI) stood at 118.3 points in March 2024, up 1.3 points (1.1 percent) from its revised February level, as increases in the price indices for vegetable oils, dairy products and meat slightly more than offset decreases in those for sugar and cereals. The index, although it registered a first uptick in March following a seven-month long declining trend, was down 9.9 points (7.7percent) from its corresponding value one year ago.

» The FAO Cereal Price Index averaged 110.8 points in March, down 3.0 points (2.6 percent) from February and 27.7 points (20.0 percent) below its March 2023 value. Global wheat export prices declined for the third consecutive month in March, mostly due to continued strong export competition among the European Union, the Russian Federation and the United States of America. Amid ample supplies, cancelled wheat purchases by China (from both Australia and the United States of America) placed downward pressure on markets, while favourable crop prospects for the 2024 harvest in the Russian Federation and the United States of America also contributed to the softer price tone. By contrast, maize export prices edged marginally upwards month-on-month. Increasing buying interest, especially from China, amidst logistical difficulties in Ukraine and elsewhere, provided some support to maize prices, but it was countered by seasonal pressure in Argentina and Brazil where harvests are underway. For other coarse grains, world prices of barley fell while those of sorghum increased in March. The FAO All Rice Price Index declined by 1.7 percent in March, largely reflecting a subdued global import demand.

» The FAO Vegetable Oil Price Index averaged 130.6 points in March, up 9.7 points (8.0 percent) from February and reaching a one-year high. The marked rebound reflected higher price quotations across palm, soy, sunflower and rapeseed oils. International palm oil prices continued to increase in March, underpinned by seasonally lower outputs in leading producing countries that coincided with firm domestic demand in Southeast Asia. In the meantime, world soyoil prices recovered from multi-year lows, mostly supported by continued robust demand from the biofuel sector, particularly in the United States of America and Brazil. Likewise, sunflower and rapeseed oil prices recovered in March, amid rising global import demand. Furthermore, higher crude oil prices also contributed to the increase in vegetable oil quotations.

» The FAO Dairy Price Index averaged 124.2 points in March, up 3.5 points (2.9 percent) from February, marking the sixth consecutive monthly increase, but remained 11.1 points (8.2 percent) below its value in the corresponding month last year. In March, world cheese prices increased the most, reflecting the steady import demand from Asia, higher internal sales in Western Europe leading to the spring holidays, and seasonally falling production in Oceania. Notwithstanding softer Asian demand, international butter prices increased further in March, mainly due to solid seasonal demand and somewhat tighter European stocks. By contrast, after five months of consecutive increases, international whole milk powder prices dropped as global import demand softened despite seasonally declining production in Oceania. Skim milk powder prices also fell, as markets remained quiet, with lower spot demand.

The FAO Meat Price Index* averaged 113.0 points in March, up 1.9 points (1.7 percent) from February, marking the second consecutive monthly increase. At this level, the index stood only 1.7 points (1.5 percent) below its corresponding value a year ago. International poultry meat prices increased in March, underpinned by continued steady import demand from leading importing countries, despite ample supplies mostly sustained by reduced avian influenza outbreaks in major producing countries. Pig meat prices also increased, mainly reflecting higher internal demand ahead of the Easter holidays, notwithstanding increased supplies especially in Western Europe. World bovine meat prices continued to rise in March, mainly due to increased purchases by leading importing countries. By contrast, International ovine meat prices fell for the second consecutive month, principally driven by a surge in supplies exceeding seasonal levels, especially from Australia.

» The FAO Sugar Price Index averaged 133.1 points in March, down 7.6 points (5.4 percent) from February after two consecutive monthly increases, but still up 6.1 points (4.8 percent) from its value a year ago. The March decline in international sugar price quotations was mainly driven by the upward revision to the 2023/24 sugar production forecast in India and the improved pace of sugar harvest in Thailand at the final stage of the season. Large exports from Brazil also weighed on world sugar prices. However, persisting concerns over the crop in Brazil, negatively affected by prolonged dry weather conditions, continued to exacerbate seasonal trends and limited the price decline. Likewise, higher international crude oil prices also contributed to containing the decrease in world sugar prices.

* Unlike for other commodity groups, most prices utilized in the calculation of the FAO Meat Price Index are not available when the FAO Food Price Index is computed and published; therefore, the value of the Meat Price Index for the most recent months is derived from a mixture of projected and observed prices. This can, at times, require significant revisions in the final value of the FAO Meat Price Index which could in turn influence the value of the FAO Food Price Index.