New study on crop receipts as financing instrument for Africa

Agriculture continues to be the main source of employment and income for the African continent’s predominantly rural population. Yet most African farmers and agribusinesses struggle to access finance.

A new study, published by FAO and the International Finance Corporation (IFC) of the World Bank Group, explores the use of crop receipts as a financing instrument for Africa.

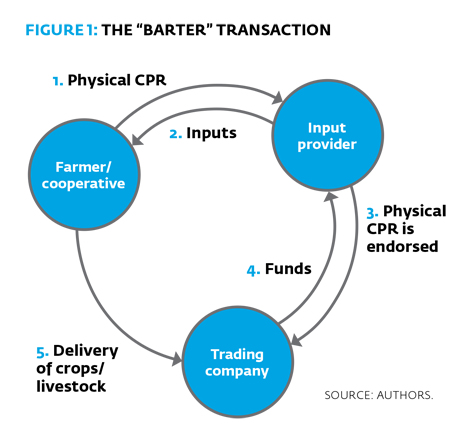

Crop receipts allow farmers to secure pre-harvest finance for inputs – either in cash or in kind – against their future production.

Frank Hollinger, an FAO rural finance specialist and one of the study’s authors, cited the lack of sufficient collateral as a major roadblock to obtaining loans.

“Normally financiers ask for collateral, like a house with a property title, which many people don’t have. Crop receipts provide additional collateral. And due to their legal strength rooted in promissory notes, they give additional comfort to financiers, such as banks, input suppliers or traders, making them more willing to provide pre-harvest finance,” he said.

The tradability of crop receipts is another advantage, he added.

“Input suppliers advancing inputs to farmers against crop receipts may face liquidity challenges themselves. But they can get cash by selling the crop receipts at a discount to traders interested in buying the crops. They can also use the crop receipts as collateral to enhance their credit line with a bank,” he said.

Entry points

Entry points

Crop receipts were first developed in Brazil in the 1990s. They have since become an important part of the country’s agricultural finance landscape.

Brazil’s success with crop receipts has sparked interest elsewhere, namely in Eastern Europe. The IFC and the European Bank for Reconstruction and Development partnered with FAO in recent years to draft crop receipt legislation in Ukraine and Serbia.

Based on those experiences, the IFC requested FAO’s assistance in studying the feasibility of introducing crop receipts in Africa. The IFC has a proven track record in post-harvest finance under its Global Warehouse Finance Program and is keen to expand into pre-harvest finance.

In addition to identifying generic preconditions, the study looked at concrete opportunities in Zambia and Uganda. A legal assessment, conducted with Norton Rose Fulbright Africa and local partners, found sufficient legal preconditions in both countries to introduce crop receipts on a pilot basis.

Commercial entry points were identified in the tea and sugar value chains in Uganda and in the dairy and maize value chains in Zambia. Other African countries are likely to have similar entry points.

According to the study, crop receipts have the potential to improve existing value chain finance arrangements in the short term. While in the medium term, they could mobilize funds from financial investors, including impact investors.

But while Brazil’s success with crop receipts provides useful guidance, it’s not a one-size-fits-all model.

To start with, the agricultural and financial systems across the African continent are different from the ones in Brazil. The majority of African farmers operate on a much smaller scale, and most value chains are less integrated.

The challenge, therefore, is to use financial engineering techniques to adjust crop receipts to African conditions, drawing on successful approaches in agricultural micro-finance and value chain finance.

Rather than creating comprehensive crop receipt legislation first, as was done in Brazil, Ukraine and Serbia, the study recommends customizing crop receipts to local conditions and introducing them gradually.

“We recommend starting with pilots to test the concept, create interest among public and private stakeholders and eventually build the foundation for a crop receipt portfolio,” said Adam Gross, an agri-finance specialist and co-author of the study.

Expanding the frontier of agricultural finance

The study concludes with a roadmap to guide the IFC and others interested in crop receipts.

“The experience of using crops receipts is not well documented, so we see this study as contributing to the general knowledge base on this subject. We hope it will also be useful to other stakeholders involved in agricultural finance in Africa – development finance institutions, impact investors, governments – who are not yet familiar with how crop receipts work,” Hollinger said.