16/03/23

European Commission announces fisheries carbon reduction strategy

In order to combat the present energy crisis, the European Commission is developing a strategy to accelerate the ecological transition of the region's fisheries and decarbonise the industry.

The rise in fuel prices induced by the Ukraine conflict has had major ramifications for EU fisheries, threatening the industry's viability. According to the Commission's figures, every EUR 0.10 per kg increase in the price of marine diesel reduces the profitability of the EU's fishing sector by an estimated EUR 188 million, or half the cost of operating the ships. The EU fishing fleet consumes about 2 billion litres of gasoline annually.

The European Commission believes that technological innovation will enable the fisheries industry to reduce its dependency on fossil fuels. In addition to increasing its adaptability and enhancing its long-term social, economic, and environmental sustainability by lowering its energy requirements and utilising more clean and alternative energy sources.

The Commission is looking to launch a new initiative to create a long-term strategy for the sector's energy transformation. The programme will establish a framework to improve stakeholder collaboration and assist in removing the obstacles that currently prevent the adoption of energy-efficient technologies.

Tags: #EU #fisheries #carbonreduction #sustainability

28/02/23

Consumers avoid plastic

According to a survey conducted by the Norwegian Seafood Council (NSC), approximately sixty percent of consumers avoid plastic-wrapped fish. The study, which included 15 000 respondents from 15 countries, provided overwhelming evidence that consumers are concerned about the widespread use of plastic for food packaging. Seventy-seven percent of consumers in Thailand avoid purchasing fish and fish products wrapped in plastic, which is an astoundingly high percentage. The Chinese are close behind, with 76 percent stating they avoid such packaging. On the other hand, the Japanese do not appear to care all that much. Only 17 percent say they avoid plastic-wrapped fish and fish products.

Tags: #plastic #products #packaging #fish #food

27/02/23

Shortage of capelin

The production of fishmeal and oil in northern Europe depends on a handful of small pelagic species. For many years, capelin was a major raw material for fishmeal, but herring landings have surpassed capelin this winter. Norway has almost no capelin quota this year, whereas herring landings have been plentiful. As a result, more herring has been diverted to producing fishmeal and fish oil.

Tags: #capelin #Norway #trade #quota #fisheries #aquaculture

24/02/23

High cod prices

The primary cod fishery in Norway begins in January and typically lasts until Easter. This is the season for catching "skrei" in the Lofoten region, and demand for this delicacy is usually high. And so it is this year, despite the rising cost of living. Even with rising consumer prices for all commodities, including electricity, gas, and interest rates, domestic demand in Norway is typically quite robust. This year is no exception. Also in high demand are fisheries and aquaculture products. Over the next few months, supplies of fresh "skrei" (Atlantic cod that spawns in the fjords of northern Norway) are expected to increase, and in the final week of 2022, prices for fresh round cod skyrocketed.

Tags:#cod #prices #Norway #skrei #fisheries #aquaculture

24/02/23

Dungeness crab

The Dungeness crab season in California began on 31 December, but the outlook is extremely uncertain. Most of the blame must be placed on the weather. Gas from a "bomb cyclone" hit California, preventing fishermen from venturing out. The Governor of California declared a state of emergency. Terrible weather led to inadequate supplies, and demand at the beginning of the year was low. As a result, prices were also down. It was anticipated that the cancellation of the snow crab and red king crab fisheries would increase demand for Dungeness crab, but this has apparently not occurred.

Tags: #dungeness #crab #trade #fisheries #aquaculture

23/02/23

Alaska snow crab

The industry was somewhat surprised when the Alaska Department of Fish and Game cancelled the snow crab season in the Bering Sea for the 2022-2023 season and closed the Bristol Bay red king crab fishery for the remainder of the season in October 2022. Scientists declared that the stocks were too low and required recovery time. Since that time, the situation has not improved. Two consecutive winters of warmer weather have prevented ice formation in the Bering Sea, altering ocean conditions. A survey by the National Oceanic and Atmospheric Administration (NOAA) revealed a decline of 80 percent in Bering Sea snow crab landings, from 11.7 million pounds in 2018 to 1.9 billion pounds in 2019. Even though snow crab prices decreased in December, primarily due to low demand, they may rise again due to inadequate supplies.

Tags: #Alaska #snow #crab trade #fishing #aquaculture

22/02/23

Shrimp trade in Malaysia during the COVID-19 pandemic

Malaysians consume between 50 and 55 kg of fisheries and aquaculture products per capita. This basket is dominated by shrimp, primarily from imports and domestic aquaculture.

From 2017 to 2021, the total shrimp harvest in Malaysia fluctuated between 80 000 and 85 000 tonnes, with aquaculture comprising 60 to 70 percent of the total. The most commonly farmed species were L. vannamei (80 percent), P. monodon (15 percent), and Macrobrachium rosenbergii (giant freshwater prawn).

The demand for farmed vannamei, available year-round in Malaysia, is typically high in the catering and retail sectors. In this market, shrimp demand and prices usually increase between January and March, coinciding with Chinese New Year festivities.

Due to dining-in restrictions and travel restrictions on foreign tourists until March 2022, sales in the hotel, restaurant, and catering (HORECA) sector decreased in 2020-2011. Despite this, overall shrimp demand remained stable at firm prices. Demand for home delivery of prepared foods remained robust during 2020-2021. The retail demand for fresh shrimp with the head attached has risen.

In the first half of 2022, shipments to the European Union, the People's Republic of China, and Japan decreased by 29 percent in volume (13 670 tonnes) and 13 percent in value (USD 112,45 million) compared to the same period in the previous year.

Nonetheless, after the reopening of Malaysian borders to tourists, the robust domestic market and the country's restaurant industry kept imports at 20 000 tonnes in the first half of 2022.

Since January 2022, the reopening of the HORECA sector and the Lunar New Year celebration in February and March have increased shrimp prices in Malaysia's domestic market. Due to an increase in demand from the catering industry, head-on vannamei (30-40 pc/kg) prices increased by 30 percent during the lunar new year in February 2022 to USD 14-15 per kg, where they remained until August. Rising prices persisted until January 2023, as demand increased during the Chinese New Year holiday.

Tags: #Malaysia #shrimp #government #trade #fishing #aquaculture

21/02/23

European Commission issues red card to Cameroon over illegal fishing

On 5 January 2023, the European Commission (EC) issued a red card to Cameroon. The EC has identified Cameroon as a non-cooperating country for failing to cooperate in the battle against illegal, unreported and unregulated fishing (IUU).

The official statement by the EC cited the reasons as the failure of Cameroonian authorities to implement appropriate corrective measures for the cessation and prevention of IUU fishing activities and to ensure adequate control over the country's national fishing fleet. Cameroon has continued to register fishing boats to fish outside its territorial waters, including one vessel engaged in illegal fishing, with inadequate monitoring of their activities.

The decision is based on the EU's 'IUU Regulation', which became effective in 2010. One of its pillars is the catch certification programme, whose goal is to ensure that only fisheries products that have been legally caught can enter the EU market. The IUU Regulation also establishes specific communication channels with countries that breach their legal obligations as flag, coastal, port, and market states. The IUU dialogues are based on cooperation and support for countries and are a crucial step in combating IUU fishing, although failure to cooperate within the parameters of the dialogue might result in the identification of the country (a so-called "red card" and subsequent "listing"). Since 2013, the commission has given "red cards" for illegal fishing to six additional nations: Belize, Cambodia, Comoros, Guinea, Sri Lanka, and Saint Vincent and the Grenadines. Belize, Guinea, and Sri Lanka have implemented measures to remove themselves from the EU's blacklist.

A red card could impede Cameroon's fishing exports to the EC. Additionally, the designation can make it illegal for EU businesses to acquire or engage in joint fishing ventures with fishing vessels flying the flag of Cameroon or to reflag such vessels. The EC will remain in communication with the Cameroonian government to provide support in addressing the issues raised.

Tags: #EU #Cameroon #fishing #IUU #EC

20/02/23

Global farmed shrimp production increased in 2022 despite low demand

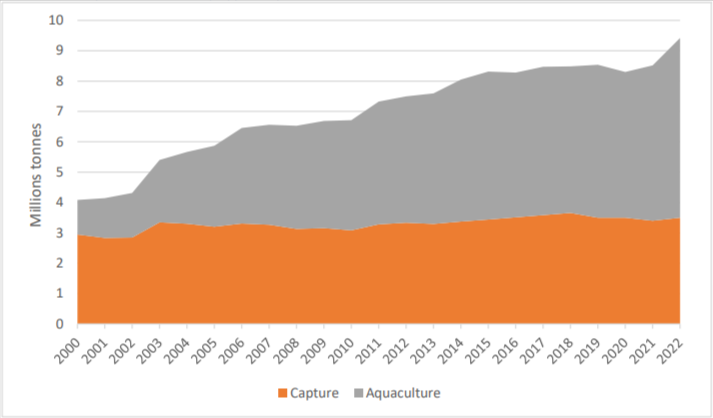

World shrimp production reached a new high of 9.4 million tonnes in 2022. The sector recovered strongly from the setbacks faced during the COVID-19 year of 2020. The share of farmed shrimp in total shrimp production increased further and reached 63 percent in 2022. Vannamei shrimp accounted for over half of the total global shrimp production.

Demand and prices of shrimp in the major markets were relatively stable from January to August 2022. From September to November, shrimp prices in the international trade started to weaken and reached low levels. Therefore, it was not profitable for many farmers to continue production, particularly in Asia. In India, shrimp farmers reduced pond stocking, and processors decreased export processing due to falling market prices. The trend is also similar in Southeast Asia (Viet Nam, Indonesia, and Thailand). Nevertheless, the production of vannamei shrimp, the main species cultured globally, rose to reach almost 5 million tonnes in 2022. Ecuador is the leading producer of this type of shrimp, with an estimated 1.3 million tonnes in 2022, a 30 percent increase over 2021. The country managed to export, for the first time in history, one million tonnes of shrimp. Shrimp farmers in Ecuador expect a further 20 percent increase in 2023, mainly due to the reopening of the Chinese market for their products.

The zero COVID-19 policy in China had an impact on the shrimp market over the course of 2022, with the closure of processing plants. When this policy was abandoned in December 2022, it resulted in a sudden reopening of the Chinese market, which had low inventories. Given the Chinese New Year in January 2023, importers were buying massive quantities at almost any price, resulting in a sharp and sudden increase in shrimp prices worldwide. 110 000 tonnes of shrimp were imported in just one month (December 2022), a 20 percent increase over November. Ecuador was responsible for 50 percent of these imports.

World Shrimp Production, by type of production

- Source: calculations and estimates based on FISHSTATJ 2023 and industry reports

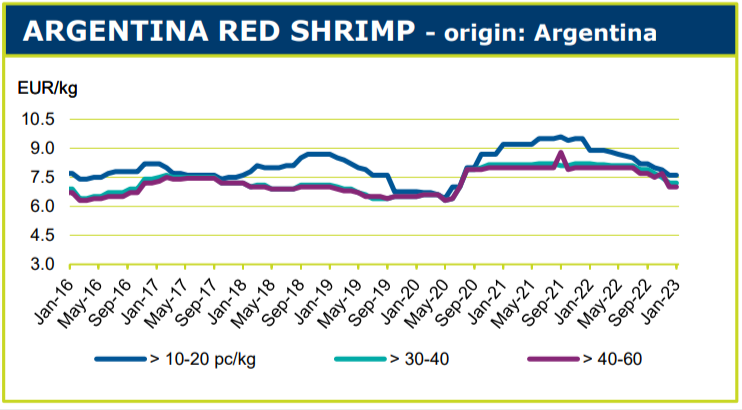

- Source: FAO GLOBEFISH European Price Report 1/2023

There is a lot of uncertainty in Europe about shrimp demand after the Christmas season, which was not as strong as expected. Several stocks are currently in cold storage, and demand is unlikely to increase before Easter. Argentina's land processing season for shrimp is about to begin, resulting in a plentiful supply. Prices for Argentine shrimp, as well as other types of shrimp, are likely to fall soon due to low demand, strong stocks, and abundant supply. Prices have already fallen from their peak in July 2021 to levels seen in early 2020.

Tags: #China #shrimp #fisheries #prices #production

17/02/23

Government of Canada to create 10 new marine conservation areas

The Canadian government has announced that it will establish 10 new national marine conservation areas as part of its plan to safeguard 30 percent of its lands and seas by 2030. The announcement was made during the 5th International Marine Protected Area Congress held on 3-9 February 2023 in Vancouver, British Columbia.

National Maritime Conservation Areas (NMCA) are marine areas that are managed to preserve representative marine ecosystems while maintaining the ecologically sustainable use of marine resources. Fisheries and Oceans Canada (DFO) is in charge of managing fisheries and aquaculture in NMCAs.

The establishment of the NMCAs would be guided under a new NMCA Policy Framework which was approved in December 2022. It strongly emphasizes the value of working with and managing projects with Indigenous peoples and establishes the direction for all existing and upcoming NMCAs.

The new NMCA policy specifies eight management objectives for the NMCA programme. A new zoning system that is more responsive to protection and environmentally sustainable use goals has also been introduced under the new policy, which specifies how NMCAs should be managed. It lists a variety of management measures for NMCAs, such as the legal instruments that must be created in accordance with the Canada National Marine Conservation Areas Act.

In accordance with the NMCA System Plan, Canada's three oceans and Great Lakes are divided into 29 marine areas. Canada is working toward the long-term objective of creating at least one national marine conservation area in each of these 29 marine regions. At present, Canada has five national marine conservation areas.

Tags: #Canada #sustainability #marine #conservation #fisheries

16/02/23

China drops its COVID-19 import restrictions and quarantines for cold chain food and non-cold chain goods

On December 28, 2022, the People's Republic of China's General Administration of Customs (GAC) issued Announcement No. 131 2022, stating that beginning January 8, 2023, all restrictive measures such as nucleic acid monitoring and detection for COVID-19 in the port for imported cold chain food and non-cold chain goods will be lifted. This is a timely change in light of China's nationwide abandonment of its "zero" COVID-19 policy. Prior to this announcement, the National Health Commission (NHC) issued a notice announcing the removal of COVID-19 preventive and control measures.

In addition, the General Office of the State Administration for Market Regulation ("SAMR") issued the Notice on Adjusting Measures for the Prevention and Control of the Epidemic Situation of Imported Cold Chain Foods in the Domestic Market. SAMR announced that beginning on 8 January 2023, the government will modify the pandemic-related measures for the prevention and control of imported cold chain food in the domestic market and will discontinue centralized supervision, nucleating acid, and disinfection.

This is the most recent change made to the pandemic prevention requirements for imported cold chain food in circulation by SAMR, the competent food safety department for the domestic market. Currently, all localities have adjusted their pandemic prevention and control policies for imported cold chain foods in accordance with the relevant SAMR deployment. This change is beneficial to the market. Previously, the country imposed strict import measures for fisheries and aquaculture products to reduce the risk of virus transmission from imported cold-chain foods. The Comprehensive Group of the State Council's Joint Prevention and Control Mechanism issued the Work Plan for the Preventive Comprehensive Disinfection of Imported Cold Chain Food in November 2020, which was implemented by customs, market supervision, transportation, health, and local governments.

The publication of the new regulations, which have numerous benefits, marked the end of disinfection, sterilization, and nucleic acid testing of imported food since the pandemic. It will streamline the importation process and increase the efficiency of goods entry and customs clearance. Second, it aids in the reduction of import costs such as nucleic acid disinfection and sterilization, as well as nucleic acid testing fees.

Although centralized supervision, nucleic acid, and sterilization of imported cold chain food have been discontinued, the Notice on Further Improving the Traceability Management of Cold Chain Food formulated by SAMR in collaboration with GAC remains in effect, and traceability of imported cold chain food will continue.

To standardize the entry of traceability information, imported cold chain food production operators, market operators, third-party cold storage operators, and other market entities should follow the Food Safety Law and relevant requirements. Imported cold chain food declarations, inspection and quarantine certificates, and other legal obligations imposed by customs law are among these requirements.

Tags: #China #COVID-19 #imports #restrictions #food #safety

15/02/23

Fisheries and aquaculture production in Kiribati

Kiribati had 114 400 people in 2016, a land area of 810 km2, a coastline of 1 296 km, and a 3.55 million km2 Exclusive Economic Zone (EEZ). In 2014, the contribution of fishing and seaweeds to GDP was estimated to be USD 13.6 million, or 8.6 percent of national GDP. The ocean surrounding Kiribati is a valuable source of livelihood for the population, providing employment, a source of income, and nutritious food. Kiribati has one of the world's highest per capita fish consumption rates, at around 77 kg per capita. More than 25 000 people work in the fishing industry. Women play an important role in shore-based activities such as processing and marketing, as well as coastal harvesting.

Total capture fisheries production increased from 63 000 tonnes in 2011 to 238 000 tonnes in 2019, representing a significant increase over previous years. Production fell in 2020 and 2021 as a result of the impact of COVID-19 on tuna export logistics.

Export earnings increased in line with increased tuna production, reaching USD 153 million in 2017, before declining to USD 94 million in 2021. The main export item is frozen tuna, with skipjack accounting for USD 60 million and frozen yellowfin accounting for USD 18 million in 2021. Thailand is by far the most important fish-importing country from Kiribati, accounting for 70 percent of total sales. The Philippines buys an additional 10 percent of Kiribati's exports. Kiribati is not permitted to export to the European Union, so exports to this market are non-existent.

| Kiribati exports of fishery and aquaculture products (in USD million) | ||||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Thailand | 91.90 | 111.0 | 93.40 | 82.50 | 75.70 | 63.00 |

| Mexico | 4.80 | 19.20 | 20.70 | 5.10 | 1.30 | 3.40 |

| Philippines | 2.20 | 5.30 | 8.10 | 14.60 | 11.20 | 9.40 |

| Japan | 7.40 | 9.70 | 8.40 | 7.70 | 4.50 | 5.50 |

| Viet Nam | na | na | na | 15.90 | 1.90 | 5.90 |

| Republic of Korea | 1.20 | 3.70 | 3.80 | 3.80 | 3.10 | 3.40 |

| United States of America | 2.90 | 3.30 | 2.50 | 2.40 | 1.00 | 0.90 |

| Ecuador | 1.00 | 1.10 | 3.50 | 0.80 | 3.90 | 2.50 |

| China | 9.50 | 0.30 | 0.10 | 0.90 | 0.00 | 0.00 |

| Others | 0.80 | 0.10 | 0.30 | 0.20 | 0.40 | 0.20 |

| Total | 121.80 | 153.60 | 140.70 | 133.90 | 102.90 | 94.30 |

A study of the island's vulnerability to climate change discovered that the country has become overly reliant on revenue from offshore foreign-flagged purse seine tuna fishing vessels. Fees charged to tuna companies accessing its 3.5 million square kilometre exclusive economic zone account for roughly 80 percent of the country's government revenue. Outside of the tuna business, Kiribati has enormous potential for developing alternative sources of revenue from the fisheries sector. Aquaculture is one option, but other types of fish, such as demersal fish species, may also be profitable. The country could also try to obtain permission to export fisheries and aquaculture products to the European Union, which could be a good source of foreign currency earnings.

Tags: #Kiribati #fisheries #aquacultre #statistics #exports #production

14/02/23

Post COVID-19 demand for imported salmon increased in Southeast Asia and the Far East

Consumer demand for farmed Atlantic salmon in Southeast Asia and the Far East has been recovering since 2021. Most of it is imported from Norway and Chile, the world’s two largest producers of farmed salmon. Smaller exporters, including Australia and the United Kingdom of Great Britain and Northern Ireland, increased their regional market share. The leading importers are the People’s Republic of China, Japan, Korea, and Thailand. Frozen salmon imports were also robust in Hong Kong SAR, Viet Nam, Malaysia, and Indonesia.

Between January and September 2022, combined imports of fresh or chilled (air-flown) and frozen salmon in the 15 regional markets climbed by 15 percent (375 384 tonnes) and 58 percent (USD 2.91 billion) due to higher imports by Thailand and the People’s Republic of China.

The People’s Republic of China, the fastest-growing market for salmon, purchased 125 185 tonnes of fresh and frozen salmon worth USD 931 million in the first nine months of 2022. Outside Japan, the People’s Republic of China has the most Japanese-style eateries, followed by Thailand.

Fresh and chilled salmon prices grew dramatically for fisheries and aquaculture products between 2020 and 2022 due to rising fuel costs and increased air freight. Throughout 2020-2022, price increases ranged from 50 to 70 percent, starting at USD 15.9 per kg in China, USD 14.9 per kg in the Republic of Korea, and USD 12.00 per kg in Thailand. Yet, demand for fresh and frozen salmon increased in Southeast Asia’s retail and restaurant trade, reaffirming the species’ popularity.

Fresh salmon fillets and steaks are priced at USD 40-60 per kg in the regional retail sector, whereas frozen thawed steaks are priced at USD 10 to 15 per kilogramme. Supermarkets also sell popular goods such as salmon heads and trims (remnants of fillets) at significantly lower prices than fillets and steaks of salmon.

| Imports of Fresh and Frozen Salmon in Southeast Asia and the Far East( 15 markets) (Quantity in tonnes, Value in Million USD) |

||||||

|---|---|---|---|---|---|---|

| January-September 2020 | January-September 2021 | January-September 2022 | ||||

| Quantity | Value | Quantity | Value | Quantity | Value | |

| Salmon products | ||||||

| Fresh/chilled | 888.58 | 100 037 | 1 192.90 | 122 708 | 1 412.42 | 103 094 |

| Frozen Pacific salmon | 620.51 | 152 347 | 599.34 | 134 142 | 911.33 | 208 845 |

| Frozen Atlantic salmon | 249.16 | 59 447 | 165.93 | 40 050 | 263.17 | 42 182 |

| Fresh/chilled Fillet | 226.28 | 17 185 | 295.21 | 22 260 | 326.62 | 21 263 |

| Total | 1 984.54 | 329 016 | 2 253.41 | 319 160 | 2 913.52 | 375 384 |

Fresh salmon products in South East Asian retail trade, Thailand.

13/02/23

Malaysia: Fish and fish product prices increased significantly due to the Chinese New Year festival

Because of high demand during the Chinese New Year celebrations from 15 to 29 January 2023, Malaysia's Ministry of Domestic Trade and Cost of Living (KPDN) gazetted the maximum retail prices of ten food items.

The popular farmed white shrimp (sizes 41 and 60 pieces per kg) has a maximum price cap of Ringgit 39 or USD 9.28 per kg, and white pomfret (weighing 200 to 400 gm) has a maximum price cap of Ringgit 42 or USD 10.00 per kg.

White pomfret is currently priced between Rm 100 (USD 24) and Rm 150 (USD 35.7) per kg on the market. Fresh and frozen salmon and salmon trout are in high demand in retail and catering, and are used to make the prosperity dish "yeesang," which is served at family dinners during the Chinese New Year festival. The current price range for frozen thawed salmon is USD 17 to 30 per kg.

Tags: #Malaysia #fish #prices #ChineseNewYear #production

10/02/23

European Commission announces fisheries carbon reduction strategy

In order to combat the present energy crisis, the European Commission is developing a strategy to accelerate the ecological transition of the region's fisheries and decarbonize the industry.

The increase in fuel costs brought on by the conflict in Ukraine has caused serious repercussions on EU fisheries, endangering the industry’. According to the Commission's calculations, every time the price of marine diesel increases by EUR 0.10 per kg, the profitability of the EU's fisheries sector declines by an estimated EUR 188 million, or half the cost of operating the ships. The EU fishing fleet uses close to 2 billion liters of fuel annually. Therefore, it is crucial to accelerate the sector's energy transition.

The European Commission believes that technological innovation will enable the fisheries industry to reduce its dependency on fossil fuels. By lowering its energy requirements and utilizing cleaner and alternative energy sources, the EU fisheries and aquaculture sector may increase its adaptability and enhance its long-term social, economic, and environmental sustainability.

The Commission is looking to launch a new initiative to create a long-term strategy for the sector's energy transformation. The programme plans to establish a framework to improve stakeholder collaboration and assist in removing the obstacles that currently prevent the adoption of energy-efficient technologies.

This Commission initiative will support the energy transition in the industry by enabling strong engagement of all stakeholders (including NGOs, fishers, aquaculture producers, shipbuilders, equipment producers, research institutes, renewable energy providers, and ports). This engagement would facilitate closing knowledge, technology, and innovation gaps in the energy transition. Additionally, the initiative would also focus on securing adequate financial support to support the energy transition.

Tags: #EU #fisheries #carbonreduction #sustainability