Excessive chemical additives found in Chinese imports of Ecuadorian Pacific white shrimp

A post on Chinese social media by a local individual has attracted great attention, warning of an excessive level of chemical additives on shrimp imported from Ecuador into China. On 18 February, the blog said that traces of sodium metabisulphite, used as a food preservative for shrimp, were found after a test was performed on products bought from an e-commerce site. In addition, 0.155g/kg of sulphur dioxide residue (formed due to sodium metabisulfite decomposition) was also detected in Chinese seawater shrimp and crab, exceeding the national edible standard of no more than 0.1g/kg.

Since sodium metabisulphite can affect health in the long term, this breaking news hit the headlines. It is worth noting that the value and volume of Ecuadorian shrimp imported into China have increased rapidly in the past ten years, especially during 2018–2022. In 2014, these figures were recorded at USD 134 029 995 and 15 818 tonnes respectively, rising to USD 3 548 486 096 and 697 357 tonnes in 2023.

In the foreseeable future, consumption of Pacific white shrimp in China will be impacted to some extent, thereby influencing both the farming and export sectors in the supplying nations.

China: Shrimp market downturn in 2023

Following the lifting of epidemic control measures in December 2022, data showed a 12.3 percent increase in the volume of shrimp imports into China in 2023, including a surge of Ecuadorian shrimp. A historic high of 1.1 million tonnes was recorded, making China the first country to reach this seven-digit milestone.

However, these imports coincided with a significant decrease in domestic demand towards the end of 2023, which resulted in market prices plunging to their lowest levels as compared to recent years. This slowdown in domestic demand growth exceeded expectations, leading to extensive hoarding by wholesalers and retailers. An industry insider commented, "Typically, when we see a significant global price drop, it stimulates demand, total volumes sold, and value growth. However, last year, in the context of China's macro-economic weakness, especially in the second half, this was an exception."

Challenges

· Weak market demand. Although China's GDP has resumed positive growth after COVID-19, the magnitude of the previous negative growth remains significant. Economic sluggishness and low consumer demand have had a significant impact on shrimp prices, a trend which became more apparent towards the second quarter of 2023. The weak situation, coupled with over-supply of various aquatic products, has led to slow turnover in wholesale markets.

· Abundant domestic production. China is one of the world's largest shrimp-producing countries and the largest producer of whiteleg shrimp. With the country's economy still in the process of recovery, this surplus production of shrimp has significantly impacted its prices.

· Excessive importation of shrimp into China. Shrimp imports were recorded at 1 million tonnes in 2023. With China's large domestic production and subdued demand, these excessive imports naturally exacerbated the situation, especially considering the low prices of imported shrimp. Additionally, port fees, and pressure on capital turnover have forced wholesale markets into a cycle of selling at low prices and incurring losses.

Prospects

Over the past decade, China has become the largest importer of Ecuadorian shrimp, absorbing 50 percent of the supplies. However, this scenario may change as the National Aquaculture Authority of Ecuador (CNA) recently stated that approximately 110 000 hectares of shrimp aquaculture areas are at risk of damage due to floods caused by the El Niño phenomenon, putting the entire Ecuadorian shrimp industry in jeopardy. If this happens, it could lead to changes in domestic shrimp prices in the future. Demand for shrimp products is likely to expand with the gradual recovery in the domestic market due to improving economic conditions and confidence-boosting measures by the Government. It is worth noting that the International Monetary Fund, in its latest "World Economic Outlook", has revised China's economic growth expectations upwards in 2024.

03/06/2024

Russian tax law revision aimed at boosting domestic seafood businesses

On 26 February 2023, the Russian Federation officially published Federal Law No. 38-FZ, amending the Russian Tax Code. Among other things, the new Law allows seafood processing enterprises to enjoy tax reductions no later than one year after harvesting, instead of the previous waiting period of three years. The new provisions enter into force from 26 March 2024 onwards.

The fishery species for which the tax reduction applies as stipulated in the amendment, includes cod, herring and haddock. Notably, based on the All-Russian Association of Fishery Enterprises, Entrepreneurs, and Exporters (VARPE) initiative, Pacific salmon was added to the list.

This is not the first time that the Russian Government has given benefits to the seafood industry as companies were previously already able to take advantage of several tax incentive measures. For instance, the value-added tax for domestic seafood enterprises which supply products to local markets is only 10 percent, which is lower than the regular rate of 20 percent.

With this amendment, the amount of tax reduction will probably exceed 1 billion rubles (USD 10.9 million) in 2024, and this figure is expected to triple in the coming years. Meanwhile, the market prices for Russian fish products such as cod and salmon are predicted to decrease considerably in the future.

For more details:

https://mp.weixin.qq.com/s/mHeWTFYL1cY1S8boVXGwRw

Two vessels designed to monitor illegal, unreported and unregulated (IUU) fishing off the Tunisian coast were received at the port of La Goulette, Tunisia, on 26 February 2024. Named “Hannibal 3" and "Hannibal 4”, the 27-metre-long, 100-ton vessels were funded at a cost of nearly 1.2 billion Japanese yen as part of a 2021 grant project between Japan and Tunisia. The project details were jointly announced by the Japan International Cooperation Agency (JICA) and the Japanese Embassy in Tunisia.

The delivery of the vessels will make it possible for the Ministry of Agriculture, Water Resources, and Fisheries' Directorate General of Fisheries and Aquaculture to monitor and control fishing vessels flying the Tunisian flag. It will also encourage the sustainable management of fisheries resources in Tunisian waters in compliance with international and national control standards. Furthermore, the project aids in the achievement of two of the United Nations’ Sustainable Development Goals: SDG 8 on decent work and economic growth; and SDG 14 on the conservation and sustainable use of life below water.

This initiative aligns with the long-standing cooperation between the Ministry of Agriculture, Water Resources, and Fisheries and JICA; as well as the governments of Tunisia and Japan, to improve the fishing industry in the region.

#Tunisia #Japan #IUU #sustainability #fisheries

- Creative Commons, Image Creator: rawpixel.com

03/04/2024

Chinese fish trade watch for December 2023

Compared with the trade trends in November 2023, Chinese imports of fresh chilled and frozen Atlantic salmon increased both in volume and value, with a correspondingly higher indicative price. Denmark overtook Norway as the biggest supplier of fresh and chilled salmon, partly attributed to the soaring price levels for Norwegian products. Meanwhile, Chile remained the main exporter of frozen salmon to China. There were more lobsters imported in total, with a massive increase from the United Kingdom of Great Britain and Northern Ireland, accompanied by significantly higher prices in December 2023. In contrast, frozen cod exports to China decreased to some extent in December, with slightly-raised prices. Frozen mackerel imports into the Chinese market remained steady, with the Republic of Korea being the largest supplier.

WTO Fisheries subsidies negotiations

Final stages ahead of the 13th Ministerial Conference1

The World Trade Organization’s (WTO) 12th Ministerial Conference (MC12), held in Geneva from 12 to 17 June 2022, led to the adoption of the WTO Agreement on Fisheries Subsidies that prohibits subsidies supporting illegal, unreported, and unregulated (IUU) fishing, bans support for fishing overfished stocks, and eliminates subsidies for fishing on the unregulated high seas. WTO member countries also agreed at MC12 to continue negotiations on open matters and propose recommendations to the 13th Ministerial Conference (MC13) for additional provisions to strengthen the Agreement's disciplines. The pillars of overcapacity and overfishing were some of the issues not agreed upon in MC 12.

As WTO member countries prepare for negotiations before MC13 in Abu Dhabi from 26 to 29 February, WTO discussions focus on fisheries subsidies. The WTO launched a "Fish Month" on 15 January 2024, in tandem with efforts to address the open negotiation issues involving fisheries subsidies. Before the MC13, WTO member countries endorsed a draft text to serve as a foundational for discussions and negotiations for curbing subsidies contributing to overcapacity and overfishing in the coming weeks. The draft text was created by combining inputs from previous negotiation texts, WTO member countries' proposals, and plenary discussions. The draft text was circulated on 21 December 2023 alongside the explanatory note. WTO member countries plan to hold sessions from 15 January to 9 February to discuss the draft text. The goal is to have a streamlined text to submit to Ministers by 14 February in preparation for MC13.

The draft text combines a list of subsidies contributing to overcapacity or overfishing alongside criteria requiring countries to demonstrate measures in place to encourage sustainable fish stocks. It also contemplates a two-tier system in which the larger subsidy providers would face more scrutiny. Meanwhile, the draft text proposes special and differential treatment provisions for the least developed country (LDC) and developing country members, including an exemption from the prohibition for developing country members with a proportion of the world fish catch of less than a certain threshold (to be negotiated), among others. Furthermore, it also proposes to exempt LDC members from the prohibition discipline.

Fifty-six2 WTO member countries have formally accepted the WTO Agreement on Fisheries Subsidies as of 31 January 2024, which is over 50 percent of what is required for the Agreement to enter into force (two-thirds of the WTO membership).

1 For more recent updates regarding the negotiations on fisheries subsidies, please check the dedicated WTO website on the topic. 2 List of countries that have submitted acceptance of the WTO Agreement on Fisheries Subsidies can be found on the WTO website.

02/02/2024

Sea shipping routes’ crisis: cost impacts

Just as we thought the worst is over, as we step into the post-covid era: shipping costs are escalating once again but under different circumstances. The crisis which surfaced from late 2023 is bringing about new challenges to industries shipping goods across the globe.

To avoid attacks by Yemeni Houthi rebels, ships that usually travel via the Suez Canal are being rerouted around the Cape of Good Hope in Southern Africa, which lengthens the journey from Asia to Europe. On the other hand, severe drought had lowered water levels at the Panama Canal prompting a limit to the number of ships that can pass through. Global maritime trade through the two channels is estimated at 12% of global trade (US$1 trillion), 5% of global maritime trade (US$ 2.5 billion) respectively.

Concerns are rife about the ricocheting costs associated with this crisis such as increased prices of goods, increased fuel and labour costs as well refrigeration costs for perishables including aquatic animal species due to longer travel times. Exporters are in the doldrums about how to cope with these added costs without burdening the end consumers or breaking existing contracts. There are already on-going delays in shipments.

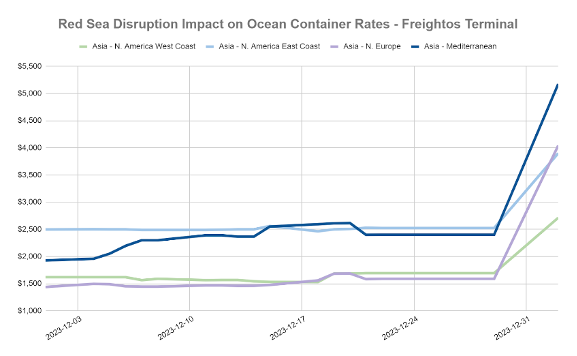

The Global Container Freight Index this week rose to as high as USD 3407. Although it was up by 211 percent since October 2023, it last peaked in October 2021 at USD 11 188.60.

Freight rates for shipping a standard container from China/East Asia to North Europe according to the Freightos Baltic Index (FBI) was up by 417 percent to (USD 5481) in the week of 23rd January since October 2023, China /East Asia to East Coast North America (USD 6141) by 177 percent and China/East Asia to West Coast North America (USD 4047) by 158 percent and China/East Asia to Mediterranean (USD 6473) by 372 percent.

The Suez Canal is of primary importance for trade between Asia and Europe, being the shortest sea route between Southeast Asia and Europe. Being a region that accounts for about 60% of the world’s population, Asia plays an important role in the global seafood supply and marketing.

Aquatic product imports from Asia | November 2022 | November 2023 | ||

MT | USD 1000 | MT | USD 1000 | |

European Union | 125 372 | 808 093 | 111 557 | 616 438 |

United States of America | 131 606 | 1 021 506 | 124 121 | 910 139 |

Source: Global Trade Tracker

Analysts from Freightos opine that the situation is expected to continue for some time and the transition is characterized by overcapacity, delays, additional costs to support the increased demand from the upcoming Chinese Lunar Year. The situation is also expected to trigger inflation posing further hurdles.

As shippers scramble to find alternate solutions and routes, it is interesting to note of the land bridge alternative across the Middle East. The bridge dubbed as an express service is expected to shorten the sea route 10 days via Saudi Arabia and Jordan to Haifa in Israel and Port Said in Egypt, from where cargo can continue to Europe and beyond.

- Source: Freightos

- Source: Freightos

01/30/2024

China's crab imports from the Russian Federation experience significant surge

With the United States of America and European Union imposing a ban on Russian seafood exports, the Chinese market has emerged as the most crucial destination for Russian crab products. According to statistics from the General Administration of Customs of the People's Republic of China, both live, fresh or chilled and frozen crab exports from the Russian Federation to China have witnessed significant growth. Overall, compared to 2022, China's import quantity of crab from the Russian Federation has increased by 74.8 percent, with the import value rising by 42.5 percent.

Breaking down the imported goods, China's imports of live, fresh or chilled crabs from the Russian Federation have surged from 20,090.4 tonnes in 2022 to 30,104.6 tonnes in 2023, marking an approximate 49.8 percent increase. The import value has risen from USD 709,788,936 in 2022 to USD 978,236,942 in 2023, representing a growth of around 37.82 percent. Monthly import value and quantity of live, fresh or chilled crabs are demonstrated in Figure 1.

The import quantity of frozen crab has surged from 3 300.6 tonnes in 2022 to 10 773.6 tonnes in 2023, indicating an impressive growth of approximately 226.4 percent. The import value for frozen crab has risen from USD 60 597,059 in 2022 to USD 119 514 444 in 2023, showcasing an increase of around 97.23 percent. Monthly import value and quantity frozen crabs are demonstrated in Figure 1.

The increase in imports is closely tied to the robust market demand in the Chinese market. According to the data from Shanghai Changxing Island Fishing Port, last year, Hengsha Fishing Port on Changxing Island received a total of 31 foreign fishing vessels for unloading, marking a 520 percent increase compared to 2022. The total import volume of live seafood increased by 430 percent year-on-year, which is primarily driven by Russian crabs. Russian king crabs shipped by sea can reach Shanghai within three days after harvesting, with a high survival rate of crabs. As Hengsha Fishing Port continues to supply more salmon, tuna, and crabs to the thriving restaurants and markets in Shanghai, the seafood trade at Hengsha Fishing Port is expected to continue growing.

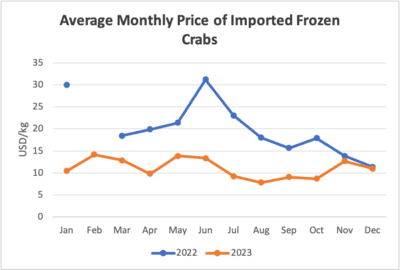

In terms of prices, despite the substantial increase in import volume, the average price of imported crab products in 2023 is lower compared to 2022. Detailed average monthly price trends are demonstrated in Figure 3 and Figure 4. The decline may be attributed to the economic sanctions affecting Russian seafood exports, leading to a surplus of supply seeking corresponding market demand.

- (Figure 1 Import Value and Quantity of Live, Fresh or Chilled Crabs from Russia Federation in 2022 and 2023)

- (Figure 2 Import Value and Quantity of Fresh or Chilled Crabs from Russia Federation in 2022 and 2023)

- (Figure 3 Average Monthly Price of Imported Live, Fresh or Chilled Crabs from Russia Federation in 2022 and 2023)

- (Figure 4 Average Monthly Price of Imported Frozen Crabs from Russia Federation in 2022 and 2023)

01/26/2024

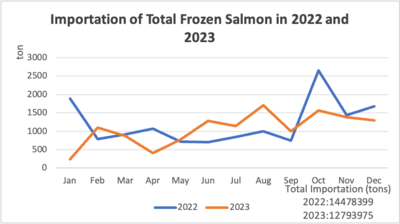

China's Atlantic salmon imports hit record high in 2023

According to the General Customs of China, China imported nearly 93 000 tonnes of Atlantic salmon in 2023, representing a year-over-year growth of 46 percent (Figure 1 and Figure 2). Notably, the import of fresh and chilled Atlantic salmon saw a robust increase, reaching 80 126 tons, with a staggering year-over-year growth rate of 63 percent. On a monthly basis, an average of 6 700 tonnes of fresh and chilled salmon were imported in 2023.

A total of 39 435 tonnes of fresh and chilled salmon were imported from Norway, maintaining its position as the leading source for several consecutive years. In 2023, the market share of Norwegian-origin fresh and chilled Atlantic salmon reached 49 percent, 1 percent higher than 2022. It is the first time for the Chinese market to surpass the Japanese and Korean markets and become the No.1 destination for Norway in exporting salmon. In the three major markets of Beijing, Shanghai and Guangzhou, the wholesale price of Norwegian salmon was at CNY 130-150/kg (about USD 18-21/kg) in December 2023. Retail price varies, for salmon sashimi in the Shanghai market it was about CNY 300/kg (about USD 42/kg).

Chilean-origin salmon secured the second-highest market share, with China importing 17 282 tonnes in 2023. This marked a 2.6-fold increase compared to 2022, and the market share further increased to 21.6 percent. This growth may be attributed to cost advantages and optimized shipping routes from Chile to China during the second and third quarters of 2023 (Figure 3). Compared with Norwegian-origin salmon, Chilean-origin salmon is sold at a lower price, since most are frozen products. Its wholesale price was at about CNY 95-115/kg (about USD 13-16/kg) and its retail price in Shanghai was about CNY 140/kg (about USD 20/kg) in December 2023.

Australia ranked third among the sources, with China importing 14 200 tonnes of salmon in 2023. Australian salmon is characterized by its proximity to the Chinese market and fast shipping times, although its supply is somewhat affected by season. The fourth and fifth-ranking sources were the Faroe Islands and the United Kingdom of Great Britain and Northern Ireland, accounting for 5.4 percent and 3.6 percent of the total market share, respectively. The combined market share of these top five sources was 97.5 percent. As for the prices, the wholesale price in China was at CNY 100 -125/kg (about USD 14-17.6/kg) in December 2023.

- (Figure 1 Importation of total frozen salmon in 2022 and 2023)

- (Figure 2 Importation of total fresh and chilled salmon in 2022 and 2023)

- (Figure 3 Average indicative prices for fresh and chilled salmon, from different producers in 2023)

01/25/2024

China released the National Biodiversity Strategies and Action Plans (2023-2030)

On 18 January 2024, the Ministry of Ecology and Environment released the National Biodiversity Strategies and Action Plans (2023-2030) (hereafter referred to “Action Plans”). It was part of the efforts to implement the Kunming-Montreal Global Biodiversity Framework, an important framework adopted in 2022 CoP of Convention on Biological Diversity.

The Action Plans are sited at the core of the compliance strategy for China, which outlines four priority areas: biodiversity mainstreaming, addressing threats to biodiversity loss, sustainable use and benefit-sharing of biological resources, and modernizing biodiversity governance. Each priority area encompasses six to eight specific actions, covering a wide range of areas such as law and regulations, policy and planning, law enforcement, monitoring and assessment, climate governance, financing and sustainable management of biological resources.

With regard to fisheries, the Action Plans propose to establish a fishery resource conservation and management system, a system for the protection and utilization of aquatic germplasm resources, improve the fishing moratorium and quota system, sustainably promote ecological aquaculture, implement a white-list mechanism for the use of aquaculture inputs, build marine aquaculture ranches and develop pilot projects with different functions like enhancement, conservation and recreation. It also states that efforts should be made to enforce the fishing moratorium system, implement autonomous moratorium on high seas fishing, crack down on IUU fishing, promote the pilot project on total allowable catch, and implement the capping system for marine fishery resources. Meanwhile, proposals such as establishing an index of biological integrity for aquatic organisms in the Yangtze and Yellow Rivers and improving the quantity and diversity of aquatic lives in the upper reaches of the Yangtze River, were put forward.

In addition, the Action Plans confirmed some ongoing actions and required further improvement, primarily the ten-year fishing ban policy in the Yangtze River, collection and preservation of germplasm resources for marine and freshwater fish species, action plans for preserving key species such as the Chinese white dolphin and Chinese sturgeon, and focused law enforcement actions against illegal fishing.

For institutions, China established a national committee specifically targeting CBD compliance, led by the vice prime minister. The Committee is consisted of 23 ministries, with the Ministry of Ecology and Environment as a core player, and the Ministry of Agriculture and Rural Affairs as the key player in relation to aquatic lives.

01/19/2024

China relaxed import restrictions for certain aquatic products imported from Brunei Darussalam

On 1 January 2024, the General Administration of Customs of China issued an announcement to relax import restrictions on certain categories of aquaculture products imported from Brunei Darussalam, after reaching an agreement with the Ministry of Primary Resources and Tourism of Brunei Darussalam.

The categories of products permitted for import are listed below. More details can be found here.

Table 1 Newly Added Categories of Aquaculture Products

(from Brunei Darussalam to China)

No. | Product Name | Latin Name | Source of product |

1 | Chinese Herring | Ilisha elongata | Marine |

2 | Yellow Croaker | Larimichthys polyactis | Marine |

3 | Hong Kong Grouper | Epinephelus akaara | Marine |

4 | Marbled Goby | Oxyleotris marmorata | Marine |

5 | Bester sturgeon | Huso huso x Acipenser ruthenus | Marine |

6 | Greasyback shrimp | Metapenaeus ensis | Marine |

7 | Pink Northern shrimp | Pandalus borealis | Marine |

8 | East Asian river prawn | Macrobranchium nipponense | Freshwater |

9 | Blue shrimp | Litopenaues stylirostris | Marine |

10 | Kuruma shrimp | Marsupenaeus japonicus | Marine |

11 | Giant Scallop | Placopecten magellanicus | Marine |

12 | Abalone | Haliotis spp. | Marine |

13 | Chilean abalone | Concholepas spp. | Marine |

14 | Maculate Ivory Whelk | Babylonia areolata | Marine |

15 | Mud Ivory Whelk | Babylonia lutosa | Marine |

16 | Green Mussel | Perna viridis | Marine |

17 | Coldwater seaweed | Porphyra spp | Marine |

18 | Blue-Green Algae | Arthrospira platensis | Marine |

19 | Green algae | Chlamydomonas spp. | Freshwater |

01/18/2024

Norway recommends 60 percent cut in king crab quota

The Norwegian Institute of Marine Research (IMR) completed a 2023 research survey that showed a significant decline in the king crab population in the Barents Sea. Consequently, IMR has recommended a drastic reduction in the 2024 quota, to just 966 tonnes. This represents a cut of 60 percent compared to 2023, when the quota was set at 2 375 tonnes. Landing statistics show that there has been a continuous decline for both male and female king crab in Norway since early 2022.

IMR also suggested that the fishing conservation period, which so far has only covered the month of April, be extended. The king crab changes its shell over a long period, from February until the end of June, and this is also when spawning takes place. Soft-shell king crab is of a lower commercial value and is more vulnerable to handling.

01/18/2024

ICES recommends notable reduction in Barents Sea cod quota for 2024

The International Council for the Exploration of the Seas (ICES) has given its recommendations for the 2024 whitefish quotas. The cod quota for the Barents Sea will be considerably reduced in 2024. The total quota was set at only 791 tonnes, down from 921 tonnes in 2023 and 1 081 tonnes in 2022. The Barents Sea haddock quota was also reduced, from 280 000 tonnes in 2023 to 267 000 tonnes in 2024. Atlantic saithe, on the other hand, has an increased quota for 2024: from 368 000 tonnes in 2023 to 382 000 tonnes in 2024.

01/17/2024

New hope for the northern cod fishery in Canada

In late October, the Canadian Department of Fisheries and Oceans (DFO) announced that there would be some important changes in the calculation of the northern cod resource. DFO said it would use the limit reference point (LRP) model hereafter, and this would lift the stock from “critical” to “cautious” under the precautionary approach. DFO said that the northern cod stock is now believed to be healthier than previously thought.

The northern cod fishery is a long-term activity that started as early as in the 15th and 16th century. In the 20th century, this fishery peaked in 1968, when 810 000 tonnes were landed before declining steadily to 140 000 tonnes in 1978, and then increasing again to 240 000 tonnes in the 1980s. However, catches were declining through the 1980s and the Canadian government finally declared a moratorium in 1992. This moratorium lasted until 2021, when DFO advised that the fishing quota could be set at 12 999 tonnes. In 2022, the quota was increased to 17 000 tonnes. Currently, it may be that the quota can be lifted when the new LRP model is being used. It remains to be seen if this will bring the old fishery back to previous heights.

01/17/2024

Peru sees higher landings

Since October 2023, there has been a positive development in Peru’s fishing industry. Landings increased significantly. In the twelve-month period ending in October, landings amounted to 319 200 tonnes, up by 202.5 percent by volume. However, prices were down, so the increase in value was only 51.6 percent. There was an 18.2 percent increase in landings for indirect human consumption. However, landings of raw materials that went for direct human consumption decreased by 18.3 percent, mainly because the landings that were for canned fish production showed a marked decrease (-25.8 percent).

01/17/2024

Lobster trade slowing down

Canada is by far the largest exporter of live and frozen North American lobsters (Homarus americanus), followed by the United States of America. However, Canada is now facing stronger competition from US exporters on both European and Asian markets. US exporters offer “firm-shell” live lobsters at prices well below Canadian “hard-shell” lobsters. Firm-shell lobsters have not yet grown their shells to hard-shell status, and are suffering from a much higher mortality rate, often between 10 and 20 percent. Hard-shell lobsters are also considered to be of a higher quality than firm-shell lobsters. The lowest grade is soft-shell lobsters, which are used mainly for processing.

The price difference at the wholesale level was quite pronounced last autumn, with hard-shell lobsters from Canada obtaining between USD 9.95 and USD 10.25 per pound, while US firm-shell lobsters were sold for between USD 7.50 and USD 7.75 per pound. Prices tend to peak in late winter and early spring, but decline notably in May. In late July prices for live hard-shell lobsters rise again as supplies are hard to find.

While 2022 was not a great year for Canadian lobster exports, 2023 looks no better. Canadian exports of live and frozen lobster amounted to 63 956 tonnes during the first nine months of 2023, compared to 69 830 tonnes during the same period in 2022 (-8.4 percent).

2022 was a poor year for US exports, too. US exports of live and frozen lobsters amounted to 22 980 during the first nine months of 2022. This was 11.4 percent less than the same period in 2021, and in 2023, exports dropped by a further 4 percent to 22 077 tonnes.

01/16/2024

Facts about seafood exports 2023

Norway exported seafood to a total of 153 countries in 2023, six more than last year.

Poland, Denmark, and the United States of America were the largest markets for Norwegian seafood exports in 2023.

Poland had the greatest increase in value last year with an increase in export value of NOK 3.2 billion, or 21 per cent, compared to the previous year.

The export volume to Poland ended at 277 745 tonnes, which is 4 percent higher than last year.

The ten largest markets by value

Poland: NOK 18.7 billion (+21%)

Denmark: NOK 14.6 billion (+16%)

United States of America: NOK 13.7 billion (+18%)

France: NOK 11.8 billion (+11%)

Kingdom of the Netherlands: NOK 10.8 billion (+16%)

Spain: NOK 8.8 billion (+20%)

United Kingdom of Great Britain and Northern Ireland : NOK 8.6 billion (+11%)

China: NOK 8.5 billion (+18%)

Italy: NOK 7.5 billion (+14%)

Germany: NOK 5.4 billion (+17%)

These markets had the greatest growth by value

Poland: NOK 18.7 billion (+3.2 billion)

United States of America: NOK 13.7 billion (+2.1 billion)

Denmark: NOK 14.6 billion (+2 billion)

Kingdom of the Netherlands: NOK 10.8 billion (+1.5 billion)

Spain: NOK 8.8 billion (+1.5 billion)

China: NOK 8.5 billion (+1.3 billion)

France: NOK 11.8 billion (+1.2 billion)

Italy: NOK 7.5 billion (+0.9 billion)

Ukraine: NOK 2.4 billion (+0.8 billion)

United Kingdom of Great Britain and Northern Ireland (the): NOK 8.6 billion (+0.8 billion)

The ten largest species measured in value

Salmon: NOK 122.5 billion (+16%)

Cod: NOK 12.2 billion (+0%)

Mackerel: NOK 6.7 billion (+7%)

Trout: NOK 5.5 billion (+10%)

Herring: NOK 4 billion (+3%)

Saithe: NOK 4 billion (+9%)

Haddock: NOK 1.7 billion (-14%)

Prawn: NOK 1.3 billion (+8%)

King crab: NOK 1.2 billion (+43%)

Blue halibut: NOK 968 million (+16%)

01/16/2024

Currency effect of NOK 15 billion

Since 2022, the Norwegian krone (NOK) has weakened, resulting in solid seafood export growth when measured in NOK. However, the growth in Euros and US dollars, which are the most important trading currencies, was significantly less.

The weak Norwegian krone and the general price increase in the markets lifted the value to a record high level. In total, the sinking value of the krone contributed to increasing the export value by almost NOK 15 billion (USD 1.5 billion) in 2023.

Norway's seafood exports last year amounted to 2.8 million tonnes, which is 5 percent less than the previous year. The two most significant species of Norway's seafood, salmon and cod, both experienced a decline in volume last year. The volume in the pelagic sector, including mackerel and herring, was the lowest since 2016.

The wild-caught species are subject to quota regulations which can affect their landings. In 2023, there was a 20 percent reduction in the cod quota, resulting in lower catches. Despite this, the export value for most cod categories increased. A similar situation was observed for mackerel, with lower catches but a record-high export value.

Salmon remains the main contributor to Norwegian seafood exports. In 2023, Norway exported 1.2 million tonnes of salmon, valued at NOK 122.5 billion (USD 12 billion), which accounted for 71 percent of the total value of all seafood exports, but only 43 percent of the volume of exports.

01/16/2024

Norwegian exports still growing in value but not in volume

The export value of Norwegian seafood reached an all-time high in 2023, with seafood worth NOK 172 billion (USD 17 billion) being exported. This equates to 39 million meals being served every day, year-round.

Compared to 2022, the export value increased by NOK 20.7 billion (USD 2 billion) or 14 per cent.

“2023 was the best value year ever for Norwegian seafood exports. Seafood is still one of Norway's most sought-after global trade goods and has firmly established itself as the country's second-largest export product, behind oil and gas”, says Christian Chramer, Managing Director of the Norwegian Seafood Council.

01/16/2024

Guyana Seabob Fisheries

One of the main fish products that Guyana exports is seabob (Xiphopenaeus kroyeri) , a type of shrimp that is harvested from the Atlantic Ocean. Guyana used to be the main producer of this species in the world, but seabob production in Guyana has experienced a substantial decline in recent years. Latest available data put production in 2021 at 9 165 tonnes, compared to 20 000 tonnes reached in 2017 and 2018 and the peak of 24 800 tonnes in 2012. Lower seabob production reduced the total seafood production in Guyana. In 2021 total production of seafood in the country was 34 400 tonnes, which compares to 54 000 tonnes in 2012 and almost 60 000 tonnes in 2003.

The reasons for this massive decline are manifold, and not really studied in detail. Some experts claim that chemical changes, mainly with regard to the salinity, in Guyana's coastal waters have caused a significant decrease in seabob production. Other experts claim that the oil drilling has caused a decline in seabob production.

Guyana seabob shrimp fishery in the Western Central Atlantic was certified sustainable against the Marine Stewardship Council (MSC) fisheries standard on 6 August 2019. This was the first fishery in Guyana to join the MSC programme, which aims to promote responsible fishing practices and protect marine ecosystems.

The certification process was requested by the Guyana Association of Trawler Owners and Seafood Processors (GATOSP) and supported by the Guyana government and WWF-Guianas. The assessment was conducted by an independent conformity assessment body, Vottunarstofan Tun EHF, and evaluated the fishery against three principles: the health of the seabob stock, the impact of the fishery on the marine environment, and the effective management of the fishery.

The certification is valid for five years, until 5 February 2025, and requires the fishery to meet 28 conditions to ensure its continuous improvement and sustainability.

In 2011, Suriname's seabob fishery became the first tropical shrimp fishery in the world to achieve the MSC certification. Thus, the MSC certification of Suriname's seabob started eight years before Guyana's.

01/10/2024

Chinese trade watch for November 2023

Compared with the trade trends in October 2023, imports of fresh, chilled and frozen Atlantic salmon increased both in volume and value and the indicative price was also higher. Norway was still the biggest supplier for fresh and chilled salmon, while Greenland was for frozen salmon. There was more frozen mackerel imported, especially for Norway. This was also the case for frozen cod. The Russian Federation supplied more than two thirds of total imports. Canada was the biggest supplier for lobsters to the Chinese market and the price dropped slightly in December. Frozen cuttlefish and squid almost doubled in imports in November, with Indonesia being the largest supplier.

01/08/2024

China released a notice on applied tariffs for 2024

China released a notice on the adjustment of tariffs, taking effect from 1 January 2024 (Notice in Chinese link here). Applied tariff rates for most fisheries and aquaculture products stay at the same level as in 2023. A few products are listed that applied a lower tariff (see Table 1). A special tax rate applies to countries having Free Trade Agreements (FTAs), including ASEAN countries, Chile, Pakistan, New Zealand, Singapore, Peru, Costa Rica, Switzerland, Iceland, Republic of Korea, Australia, Georgia, Mauritius, Cambodia, Ecuador and countries under RCEP coverage.

No. | HS Code | Product | MFN | Provisional tariff |

1 | 01061211 | Improved species of whales, dolphins and porpoises: manatees and ruliang | 10 | 0 |

2 | 03021410 | Fresh chilled Atlantic Salmon | 10 | 7 |

3 | 03031310 | Frozen Atlantic Salmon | 7 | 5 |

4 | 03033110 | Frozen Greenland Halibut | 7 | 2 |

5 | 03033200 | Frozen Flounder | 7 | 2 |

6 | 03034100 | Frozen Albacore Tuna | 7 | 6 |

7 | 03034200 | Frozen Yellowfin Tuna | 7 | 6 |

8 | 03034400 | Frozen Bigeve Tuna | 7 | 6 |

9 | 03034510 | Frozen Atlantic Bluefin Tuna | 7 | 6 |

10 | 03034520 | Frozen Pacific Bluefin Tuna | 7 | 6 |

11 | 03034600 | Frozen Southern Bluefin Tuna | 7 | 6 |

12 | 03035100 | Frozen Herring | 7 | 2 |

13 | 03035990 | Frozen Capelin | 7 | 5 |

14 | 03036300 | Frozen Cod | 7 | 2 |

15 | 03036700 | Frozen Alaskan Pollock | 7 | 2 |

16 | 03036800 | Frozen Blue whitings | 7 | 2 |

17 | 03038910 | Frozen Ribbonfish | 7 | 5 |

18 | 03038990 | Frozen Sebastes | 7 | 5 |

19 | 03061490 | Frozen Other Crabs | 7 | 5 |

20 | 03061640 | Frozen Northern Pandalus | 5 | 2 |

21 | 03061790 | Frozen Shrimp and Prawns | 5 | 2 |

22 | 03063190 | Live, Fresh, and Chilled Rock Lobsters | 7 | 5 |

23 | 03078190 | Live Fresh, and Chilled Abalones | 10 | 7 |

24 | 05119111 | Fertilized Fish Eggs | 12 | 0 |

25 | 05119190 | Artemia Eggs | 12 | 6 |

01/08/2024

Farm shrimps in the desert areas and innovation success

Dr Hamada Elkady, with good academic training and rich experience in aquaculture, has shown us how it is possible to farm shrimp in a desert area such as Egypt. Under his lead, Wadi El Natrun farm transformed from traditional tilapia farming to the more profitable vannamei shrimp farming in an innovative manner. This allowed it to survive the high feed costs. Now the farm has 14 ponds fed by groundwater on 70 acres of land, with wastewater used in a hydroponics component to produce salt-tolerant crops. He gives out some key takeaways for anyone who might want to try and achieve success:

- A place with a water source that has the right suitable salinity for aquaculture. The 20-30 ppt (parts per trillion) level is good for high feed conversion rates and low disease incidence. In the case of Wadi El Natrun farm, it uses groundwater by pumping from wells and wastewater in a hydroponic component.

- Sandy loam soil which may retain water. In desert areas, it will lower the costs of lining the ponds.

- Electricity supply for aerators and pumps from the well (if needed). Solar energy would be a good choice.

- Trained workers and experience. Desert areas are more difficult to farm. Hamada has good knowledge of aquaculture and worked for quite a long time in the industry.

- Promising production systems. Intensive and semi-intensive systems such as biofloc and recirculation aquaculture systems (RAS) may work well.

For the full interview of Dr Hamada Elkady’s story, please refer to the article on the Fish Site.

01/08/2024

Chile’s Fisheries Law set to change in 2024

Chile’s fishing industry is set for a major overhaul as the government adopts a new fishing legislation. The New Fisheries Law draft was submitted to the Congress for review on 3 January 2024.

The aim of the proposed legislation is to create fishing regulations that are the result of open discussion and allocate marine resources in accordance with scientific standards. It also seeks to develop regulations that acknowledge the cultural and economic significance of artisanal fishing.

The new law makes several modifications that could alter the dynamics of Chile's fishing sector. It suggests reducing the historical industrial fishing quota from 85 percent to 50 percent, which could shift the balances in favour of artisanal fishermen. It also seeks to reduce the 20-year validity period of transferable fishing licenses to 10 years. Further, it introduces a new system of transferable licenses based on interregional equity and scientific standards, and mandates having management plans for all fisheries to promote sustainable fishing practices. The new law also aims to modernize auction rules for allocation of resources in order to increase competitiveness and transparency.

Chile’s new fisheries law is expected to improve industry transparency, raise standards and eliminate corruption. Improving the allocation of quotas between artisanal and industrial fishers is anticipated to promote equity. The preservation of exclusive zones and the legal recognition of their associations will bring additional recognition to the artisanal fishing industry. In addition, it promotes sustainable fishing practices and advancement of knowledge and innovation within the sector while considering the concerns of all stakeholders.

01/03/2024

Price of salmon soars in the Chinese market during year-end New Year

During the year end and into the first week of 2024, prices of frozen salmon in Beijing and Shanghai soared in the Chinese market. According to a report from the Beijing market, fish sized 7-8 kg/tail from Norway was quoted at CNY 144/kg on 28 December 2023, and those sized 5-6kg/tail from Australia were quoted at CNY 113/kg on 30 December 2023. Fish from Chile was relatively cheaper. See Table 1 for more details.

Date of price quote | Area | Origin | Size (kg) | Price (USD/kg) | Tagged producing date |

3 January | Beijing | Norway | 5-6 | 17.64 | 28 December 2023 |

|

| Norway | 7-8 | 21.53 | 28 December 2023 |

|

| Norway | 8-9 | 21.23 | 28 December 2023 |

|

| Norway | 9+ | 21.53 | 29 December 2023 |

|

| Canada | 8-9 | 19.73 | 28 December 2023 |

|

| Australia | 4.5-5 | 15.40 | 30 December 2023 |

|

| Australia | 5-6 | 16.74 | 29 December 2023 |

|

| Chile | 6-7 | 10.47 | September 2023 |

|

| Chile | 7-8 | 17.94 | 28 December 2023 |

The trend was similar in Shanghai market ( See Table 2).

Date of price quote | Area | Supplier | Size (kg) | Price (USD/kg) | Tagged producing date |

3 January | Beijing | Norway | 6-7 | 21.68 | 29 December 2023 |

|

| Norway | 7-9 | 20.93 | 28 December 2023 |

|

| Australia | 4.5-5 | 14.65 | 30 December 2023 |

|

| Australia | 5-6 | 16.15 | 30 December 2023 |

|

| Australia | 6-7 | 10.47 | 30 December 2023 |

Prices in the first week of January went up by about USD 3.5/kg on average for fish sized at 6-7 kg/tail. Fresh and chilled fish are especially high in demand. The soaring price is attributed in part to the New Year holiday in China coupled with the supply shortage. Since the price for fish from Norway is too high, it is expected that the salmon from Australia may be more attractive to traders in the following weeks.

Source of information: https://mp.weixin.qq.com/s/9sB_PK2OhtWm6iudftC1AA

01/02/2024

China lifted its importation ban on groupers from Taiwan Province of China

On 22 December 2023, the General Customs of China issued an announcement (Dong Zhi Jian Han [2023] 30) that lifted the importation ban of the farmed grouper fish from Taiwan Province of China. A total of seven registered farms are granted permits to resume their trade activities from 22 December 2023, after a ban placed on 13 June 2022.

Grouper fish is one of the 18 agriculture products which enjoy preferred tariffs under the cross-strait Economic Cooperation Framework Agreement (ECFA). Since fresh or chilled grouper is a very popular food in mainland China, and its price is relatively high among freshwater fish from aquaculture, the trade interest is high. This benefit has attracted many Taiwan producers. Export has expanded and reached about 6 681 tonnes (USD 58.90 million) in 2021, about 93 percent of all its grouper exportation, and about 80 percent of its total production.