02/24/2017

Rural Women in Latin America: Realizing An Untapped Opportunity with Sustainable Solutions

By Anna Gincherman, Chief Product Development Officer at Women's World Banking.

According to the World Bank, “approximately 70% of all MSMEs in emerging markets lack access to credit,” this despite the major role they play in economic growth, especially in emerging markets. This state of affairs disproportionately affects women: data from the International Finance Corporation shows that up to “70% of women-owned SMEs in the formal sector in developing countries are unserved or underserved by financial institutions – a financing gap of around $285 billion.”

There is a particular imperative to close the financing gap for women, apart from representing a tremendous market opportunity and a good client base: women in general have lower portfolio at risk, are more loyal customers and tend to buy more products. We know that giving low-income women access to financial services contributes to the advancement of families and societies. We also know that inclusive economies are key to sustained growth—to the tune of 12% growth in income per capita in 15 emerging markets, according to Goldman Sachs.

In Latin America, roughly 35 percent of women have access to a bank account. Given the broader challenges rural communities have in accessing basic services in general, it is safe to assume this figure is much higher. Despite this glaring untapped market, few institutions have stepped up to meet this opportunity. Nevertheless, there were three institutions in Latin America who recognized rural women as opportunity: Banco Interfisa (Paraguay), Fundación de la mujer (Colombia) and Caja Arequipa (Peru), and with support from the Inter-American Development Bank, we worked with them to develop sustainable credit products that met women’s needs.

Designing for sustainability

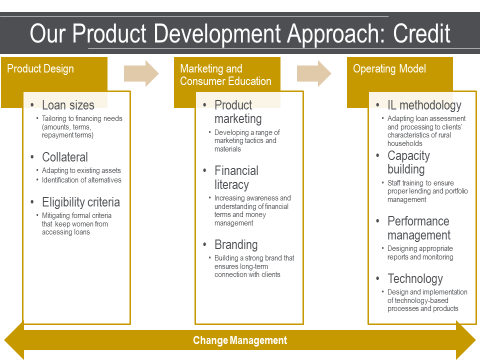

Women's World Banking’s product development process looks at three key areas of creating a sustainable proposition. In product design, we ensure product features are aligned with the target market’s needs and capacities, noting for instance, the seasonal nature of rural businesses and its impact on repayment capacity as well as the collateral available. We make sure that marketing and consumer education efforts employ tactics that reach the target clientele and are adapted to their levels of literacy and access to certain channels. Last but not least, we develop a thorough operating model that addresses practical issues such as distance to branches, use of technology to lower costs, as well as performance management and any skill-building required for smooth operations.

What do we know about rural women?

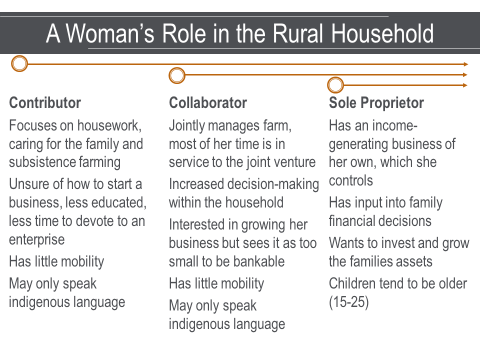

Key to serving this market is understanding women’s needs, preferences and the context with which she uses financial services. Our in-depth market research revealed that in this region, women occupied one of three roles in the rural household. Contributors lived households where the male is clearly in charge and is a dominant income earner and decision maker. Collaborators lived in a more cooperative household where the couple shares the business and the household functions as a single economy. Sole Proprietors are women who have a voice in the household and make decisions cooperatively with their husbands but nonetheless keep the businesses separate as his and hers.

We also learned two key insights that were critical to the development of their rural credit products:

- Men and women in rural families both underestimate women’s contribution to the household income,

- Male officers underestimate the women’s contribution and might not even analyze this income as part of the loan assessment.

These insights meant that women were excluded as customers and a significant portion of the family income was disregarded. For instance, when I was in Paraguay accompanying a loan officer deploying a revised credit methodology, we were all surprised (the loan officer, the prospective client and her husband, and myself) that her periodic, but regular income from her egg and milk harvesting business actually surpassed her husband’s income from the annual harvest.

Disregarding women’s contributions has another effect: it increases credit risk because loan assessments were relying on the income from one large harvest for repayment and not taking into account the steady cash flow of women’s activities.

Practical, insight-driven solutions to serving rural women

Even though each financial institution we worked with had goals and challenges that were unique to their business, our experience in these three markets identified six principles for financial institutions to consider when looking to reach rural women.

- Adjust product features (loan terms, collateral, documentation) to make credit accessible to women and relevant to their economic activities.

- Allow multiple loans per household

- Target women specifically – marketing campaigns in her language and on her terms (distribution channels)

- Modify existing credit methodologies to measure the entire family income and the growth potential of all income generating businesses.

- Train staff to see women as viable and valuable clients.

- Measure how well you serve women and connect it to your key performance indicators

And we know these interventions work. At the end of the project period, the three financial institutions collectively reached 80,000 clients, 46% of whom were women. Of course, access to credit is just the first step in truly tapping the opportunity presented by low-income rural women. Technology is making access to financial services much easier, opening room to serve women more holistically across her various needs and life stages, through savings, insurance and pensions.

Anna Gincherman

Anna Gincherman is Chief Product Development Officer at Women’s World Banking and is responsible for identification and roll-out of innovative financial solutions tailored to the needs of low-income women. She provides the organization’s thought leadership on the delivery of gender-sensitive financial products and has extensive experience in individual and rural lending, adult and youth savings, health insurance, and financial education.

Women’s World Banking is the global non-profit devoted to giving more low-income women access to the financial tools and resources essential to their security and prosperity. Headquartered in New York, Women’s World Banking works with 40 institutions in 29 countries with a reach of 16 million women.

Click here to read this article in Spanish.

Related videos:

Serving Rural Women in Latin America

Nde Vale! Credit for rural women in Paraguay with Banco Interfisa

Related Publication;

Making Women’s Work Visible: Finance for Rural Women

The Smart Territories Platform Team would like to thank Anna Grincherman and Women’s World Banking for this article.